The investment landscape shifted substantially in 4Q23, with investors

moving to price in a monetary policy pivot from the Fed. Our EM equity

strategies performed well against a backdrop of falling bond yields. Several of

our key calls generated positive alpha, including Brazilian rate-sensitive

names, Mexican nearshoring beneficiaries, Argentinian oil stocks, and Korean

memory plays. In this piece, we discuss our outlook for the coming year

and the positions that we expect to be the key drivers of potential further

alpha.

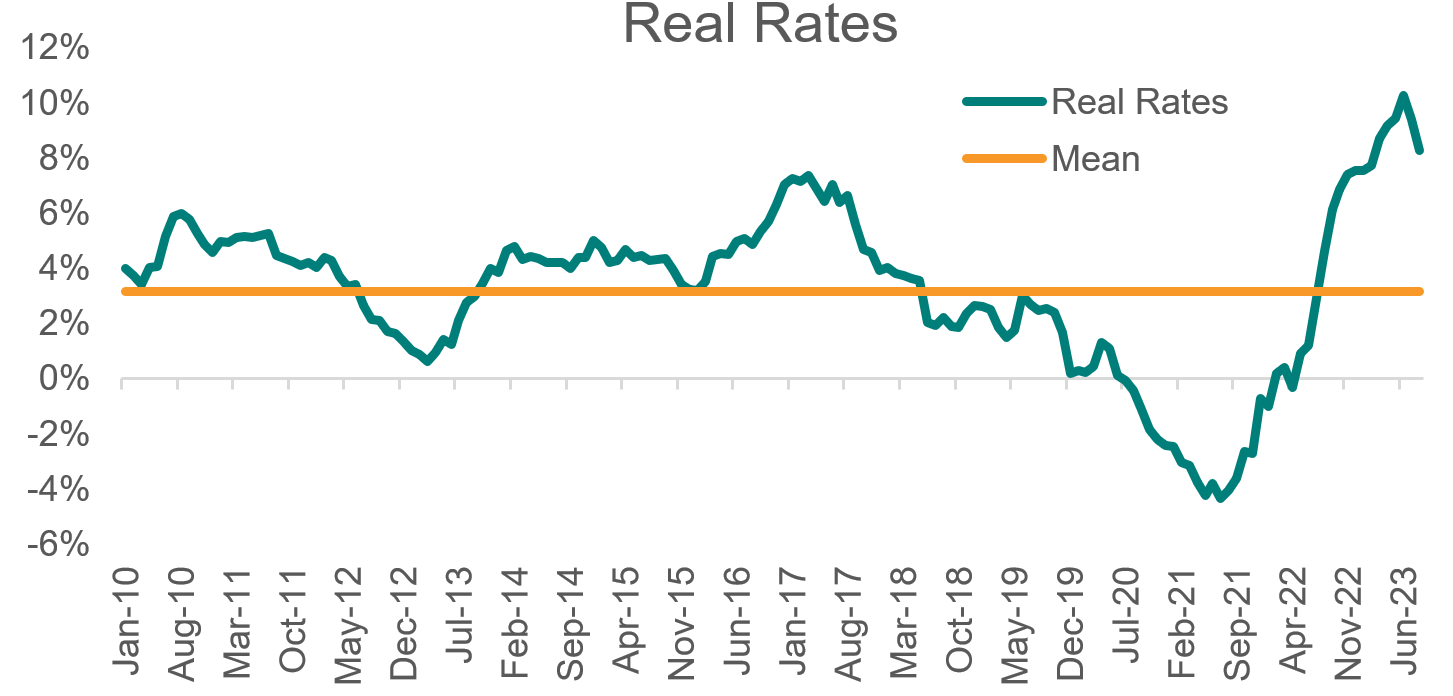

With real rates in much of EM at anomalously high levels and inflation falling in many countries across LatAm and Asia, we have been positioned for EM central banks to lead the upcoming easing cycle. This thesis was tested over the summer of 2023 as resilience in the US economy caused bond yields to increase sharply, weighing on our rate-sensitive holdings in countries such as Brazil. However, we believed strongly that the US economy could only defy the gravity of high rates for so long before cracks began to show, and therefore elected to stick with these positions. Investors have since started to

price in a policy pivot, with bond yields rolling over substantially. Our

portfolios have performed well against this backdrop, with the Global Emerging Markets and

Emerging Markets Unconstrained strategies beating their benchmarks by +3.04%

and +2.54% gross (+2.91% and +2.41% net) respectively in the final two months

of the year (data as at 31/12/23). We remain extremely confident that our EM portfolios have

significant pent-up outperformance in them, and fully expect this to

materialise in 2024. We will now turn to our outlook for key markets in 2024.

US

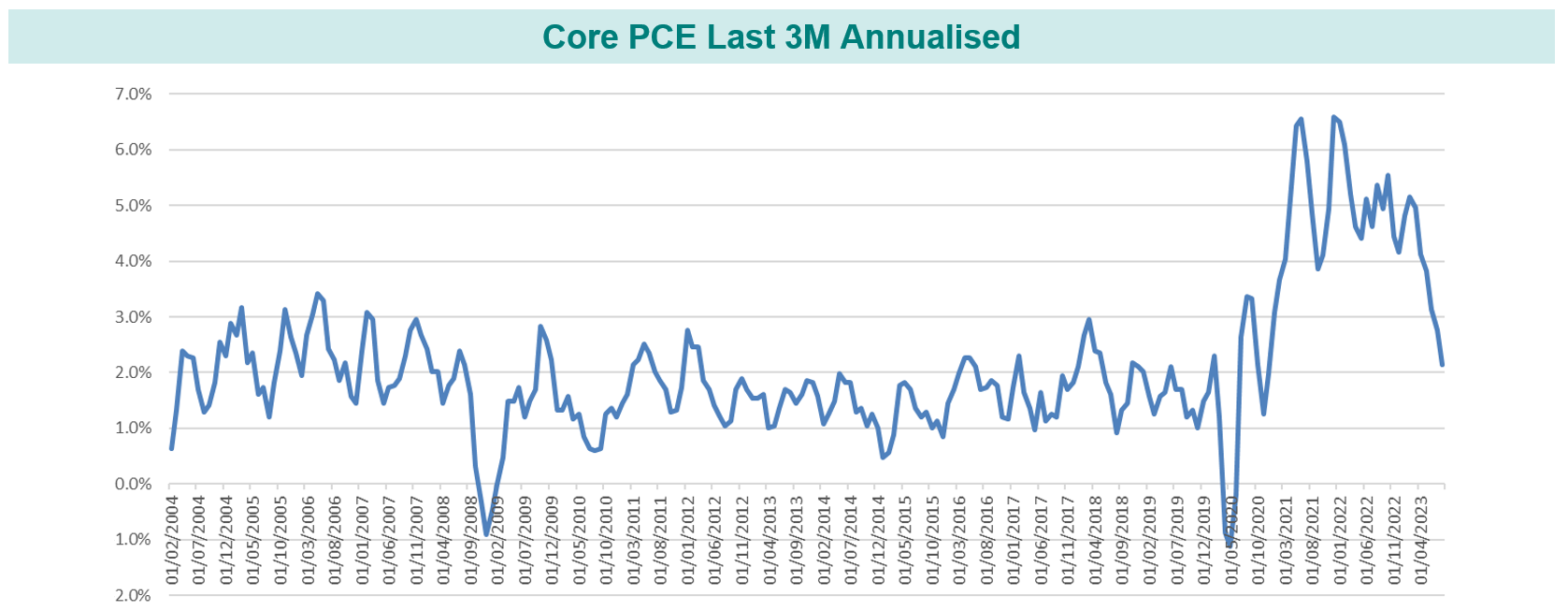

US inflation has fallen sharply, with the 3-month annualised Core PCE now back at 2.3%.

Source: Bloomberg/TT International (Data as at December 2023)

Core PCE is the Fed’s preferred measure of underlying inflation, and our base case is therefore that the US central bank has finished raising rates for this cycle. Historically, a peak in the Fed Funds Rate has coincided with a top in the 10-year bond yield. Given that rising yields have been a strong headwind for EM equities, this is like to bring relief to the most pressured markets.

Of course, part of reason for lower inflation is that the US economy is weakening. Although it has proven remarkably resilient thus far, the full impact of higher yields will take time to feed through. The Chicago Fed estimates that roughly one-third of the impact on GDP, and 60% of the impact on total hours worked, will still be felt over the next two years.

Labour demand already appears to be slowing, with the current downward trend in the jobs-workers gap suggesting that the labour market will be fully balanced by 2H24. In that situation, many workers who lose their jobs will struggle to find new ones, and the unemployment rate will rise. As jobless workers rein in spending, others will be laid off, and economic activity will weaken further. The Fed will likely respond by cutting rates, but due to the aforementioned lags in monetary policy transmission, the US economy is likely to experience a recession in 2024. Our base case is that such a recession is reasonably mild, in line with a ‘soft landing’ narrative.

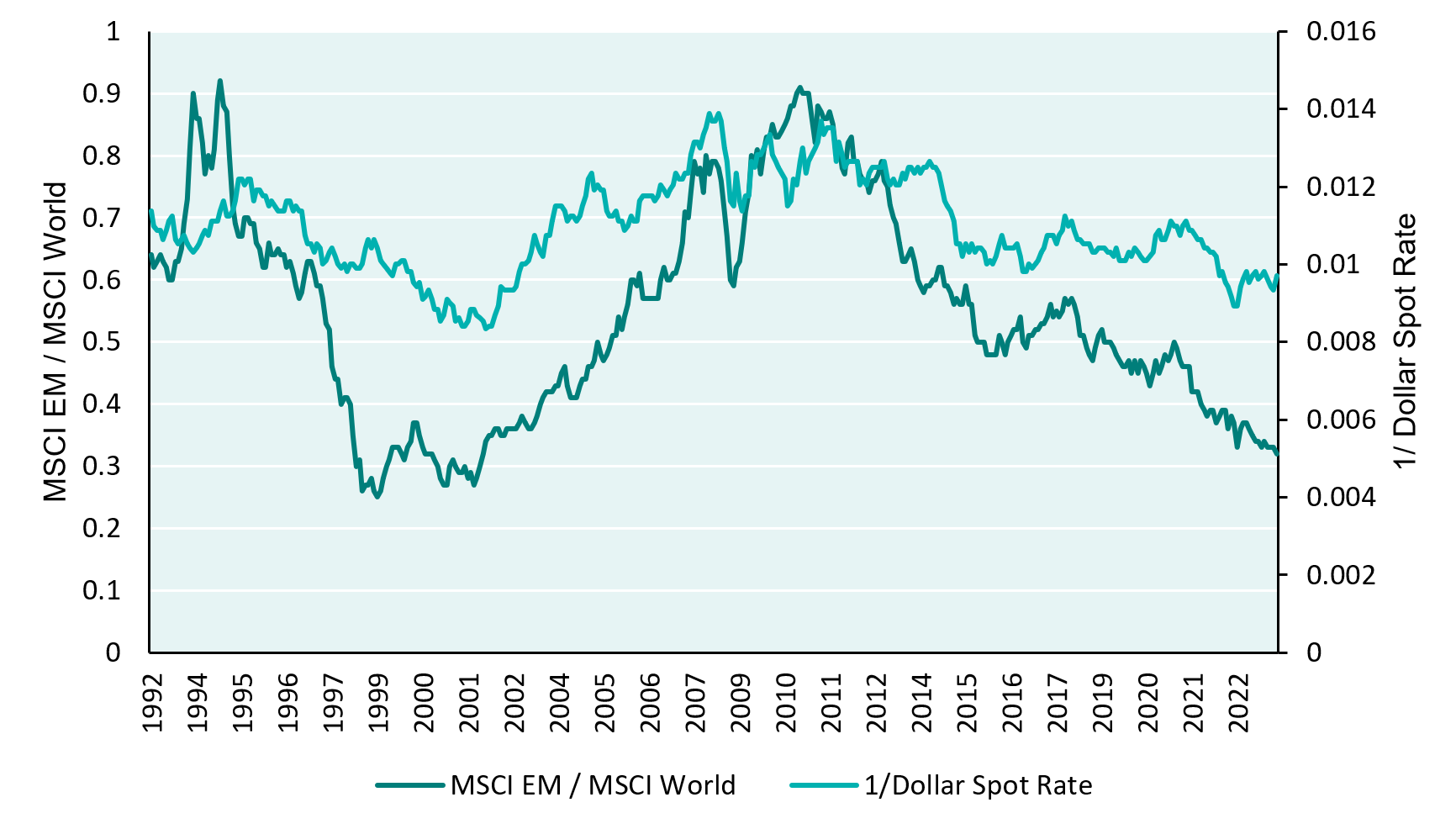

We expect this economic slowdown and subsequent rate cuts to translate into currency weakness, particularly given the fact that the dollar is around 40% overvalued in Real Effective Exchange Rate terms. Such dollar weakness should be a tailwind for our universe. As can be seen below, EM equity performance versus DM tends to move inversely to the dollar, with a correlation coefficient of over 0.8.

Source: Bloomberg, TT International (Data as at November 2023)

China

We wrote an in-depth piece on China a couple of months ago, and our view remains largely unchanged. We believe that China’s high-savings, high-investment model has reached its limit, and for sustainable future growth, the economy must become far more consumption-driven. This ultimately means that demand must now catch up with supply. However, this is no mean feat as the country faces multiple drags on consumption, including a youth unemployment rate of 20%, a falling working-age population, negative wealth effects from a weaker housing market, and a lacklustre post-covid reopening. Whilst the country does have scope to mitigate some of these issues by injecting stimulus, there is a distinct lack of visibility over the Chinese Communist Party’s motivation to do so as President Xi continues to prioritise concentrating political decision-making power. China therefore remains a major underweight in our portfolios. All that said, China is clearly a vast market and there are attractive pockets within it. Where we find good opportunities there, we will buy them.

India

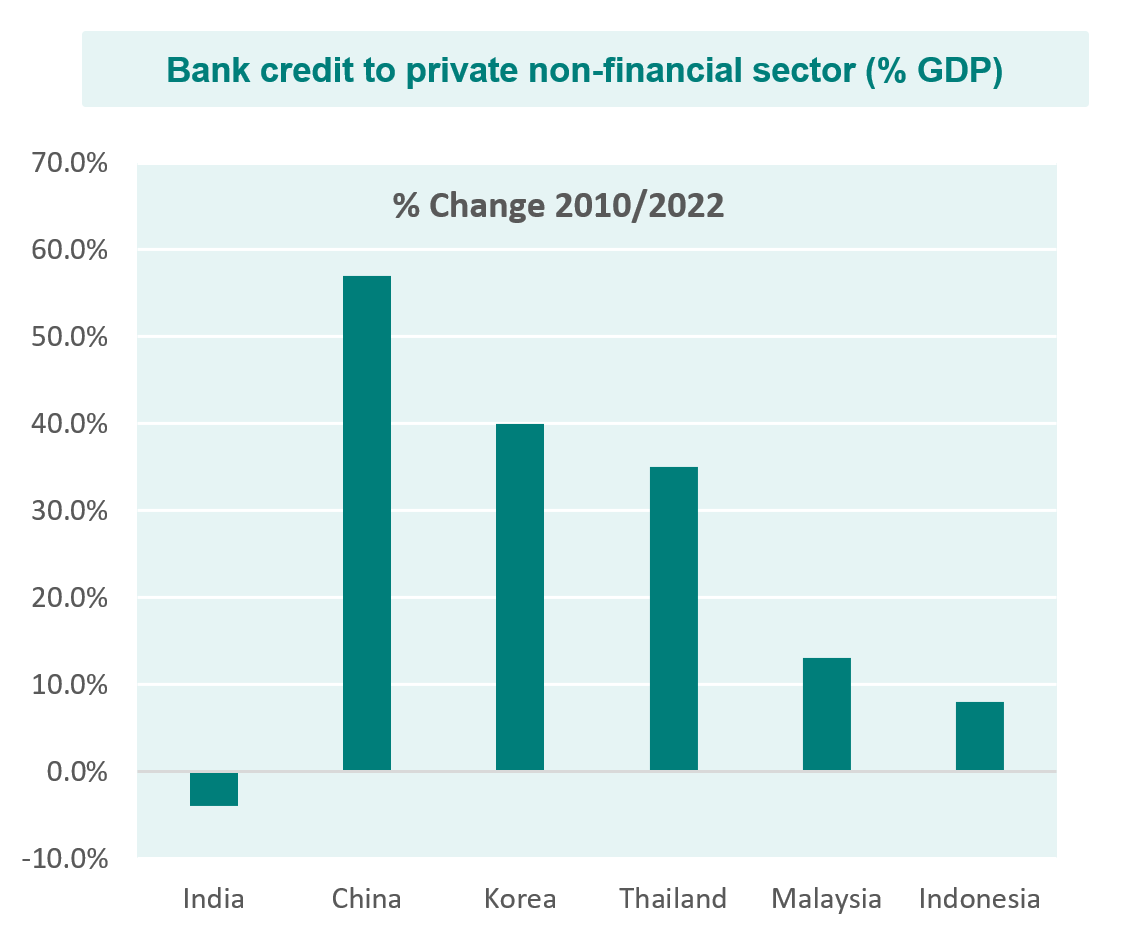

We expect India to remain amongst the fastest growing economies globally in 2024 as an investment cycle takes hold. Over the past decade, Indian banks have deleveraged and repaired their balance sheets substantially.

Source: TT International, Citi Research, Morgan Stanley, CRISIL (Data as at 2022)

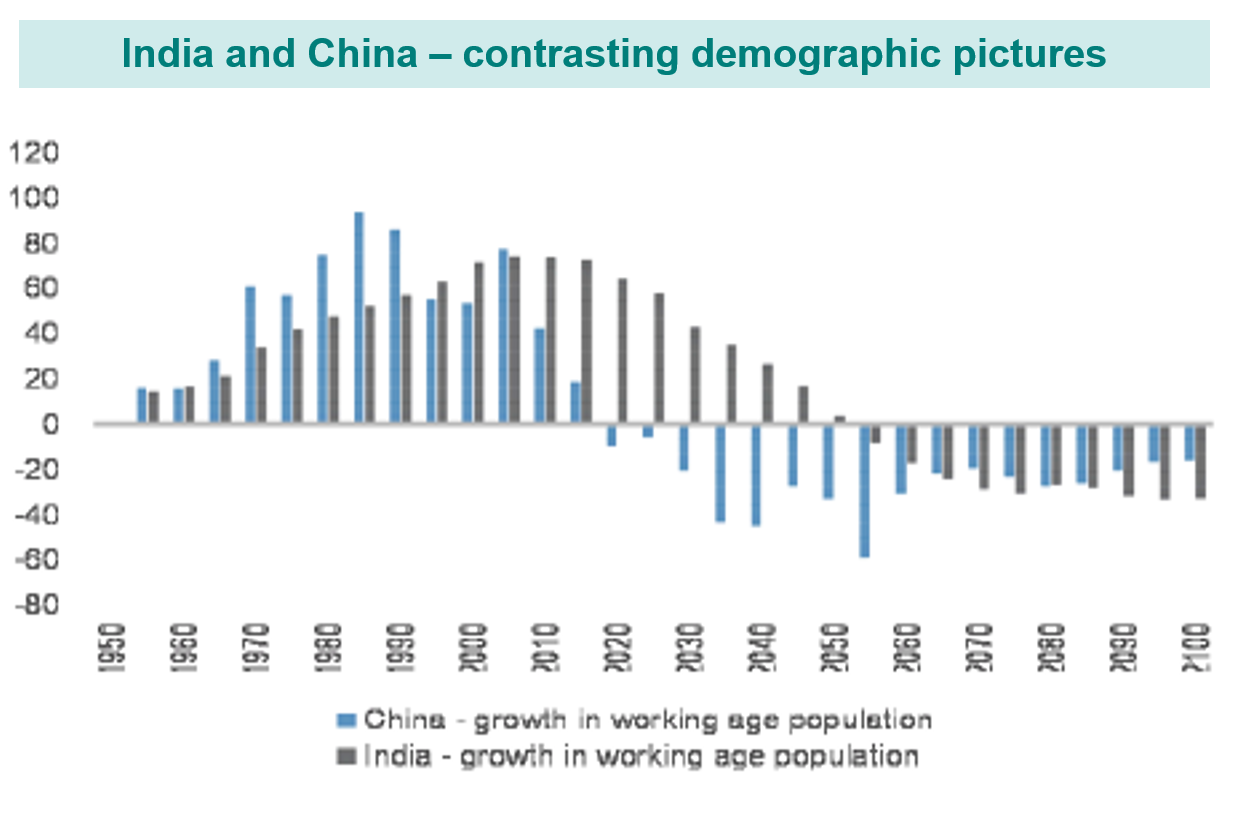

Banks are now well capitalised and ready to fund the nascent investment cycle. Although valuations remain a challenge in some areas of the market, the structural opportunity is vast. In sharp contrast to countries such as China, India will add over 100 million people to its working age population between 2020-2030.

Source: TT International, J.P. Morgan, World Bank, UN (Data as at December 2023)

It is early in its labour productivity journey, with a GDP per capita of $2.6k. History shows that countries can reach a level of $10k simply by moving households out of farming and into manufacturing. The government is helping to drive this change by implementing a more proactive industrial policy that focuses on upgrading India’s domestic manufacturing capabilities. Its efforts will undoubtedly be boosted by investment from multinational corporations looking to diversify away from China and access India’s immense low-cost labour pool. We continue to own several Indian banks and companies that are exposed to growing domestic consumption.

Taiwan and Korea

We see an extremely attractive structural growth opportunity in both logic and memory semiconductors, driven by rapidly increasingly demand from a range of new applications, most notably High-Performance Computing and AI. Digitalisation had already been accelerating for some time, but this has now been turbocharged by AI. At the same time, we are emerging from a cyclical trough, where semiconductor inventories have been run down substantially. We believe this powerful combination of structural and cyclical drivers as well as attractive valuations should result in a period of outsized returns for shareholders. We therefore own a number of semiconductor/memory plays in Taiwan and Korea.

One of the sub-themes we are playing in this area is advanced packaging. As Moore's Law approaches its limits in terms of performance, power and scaling, it is becoming increasingly challenging to improve chip performance at a reasonable cost. However, by pulling high-speed chips such as processor cores into leading-edge nodes, and keeping the rest of the chips at other nodes, such heterogenous constructions can be ‘packaged’ together to make them more powerful, as well as cheaper and quicker to produce. Advanced packaging is therefore pushing system performance boundaries and helping to drive AI chip capabilities. We believe the demands from AI and Machine Learning will usher in a new era for advanced packaging, and therefore own several beneficiaries of this.

Brazil

Real rates in Brazil remain extremely elevated. If the Fed is indeed finished with its rate hikes, this should refocus the market’s attention on Brazil’s capacity to cut. The central bank has started the process, but we expect another 300-400bps in cuts over the next year or so.

Source: Bloomberg, TT International (Data as at 31/08/2023)

Importantly, we believe that the Brazilian currency will be resilient in the face of such cuts, partly because it is around 20% undervalued on a Real Effective Exchange Rate basis, and the carry remains high. The currency should also be supported by a positive inflection in Brazil’s trade balance. Export volumes of agricultural commodities and oil have been growing rapidly over the past 10-15 years, and such volume growth is now being combined with a strong pricing environment. This terms-of-trade improvement means that Brazil’s trade balance is currently running at almost $10 billion per month. On an annualised basis this equates to nearly 6% of GDP – close to twice the level of previous peaks. Over time this could transform Brazil’s current account, potentially leading to structurally lower interest rates. Whilst our primary motivation for overweight exposure in Brazil is a cyclical rebound from heavily depressed valuations as the cost of capital normalises, we also believe that this structural element is underappreciated by the market. We therefore continue to own companies that should benefit from a normalisation in the cost of capital, particularly in the mid-cap space, where many rate-sensitive companies appear to offer compelling deep-value opportunities.

Mexico

We did a deep dive into Mexico in a recent piece and will therefore keep this section short, but suffice to say we still believe that the country has a generational nearshoring opportunity as companies look to diversify away from China and access cheap labour. For this reason, Mexico should continue its recent economic strength, with manufacturing exports growing rapidly. To contextualise the scale of this structural growth opportunity, if Mexico were to capture just 3% of China’s manufacturing Gross Leasable Area, its industrial footprint would double. Moreover, real rates in Mexico are close to the highest available in EM, providing significant scope for monetary stimulus should trends deteriorate. We continue to have exposure to nearshoring beneficiaries, most notably the banks that are financing this nascent investment boom.

Argentina

The decision to elect radical libertarian Javier Milei changes Argentina’s political and economic landscape significantly. Milei has proposed to significantly reduce state interventionism and chronic fiscal deficits. Given the scale of the challenges facing Argetina, Milei’s inexperience, and the limited amount of political capital available to spend, successfully implementing his macro-orthodox adjustment plan comes with a high degree of execution risk. We will be keen observers of how the economic transformation unfolds.

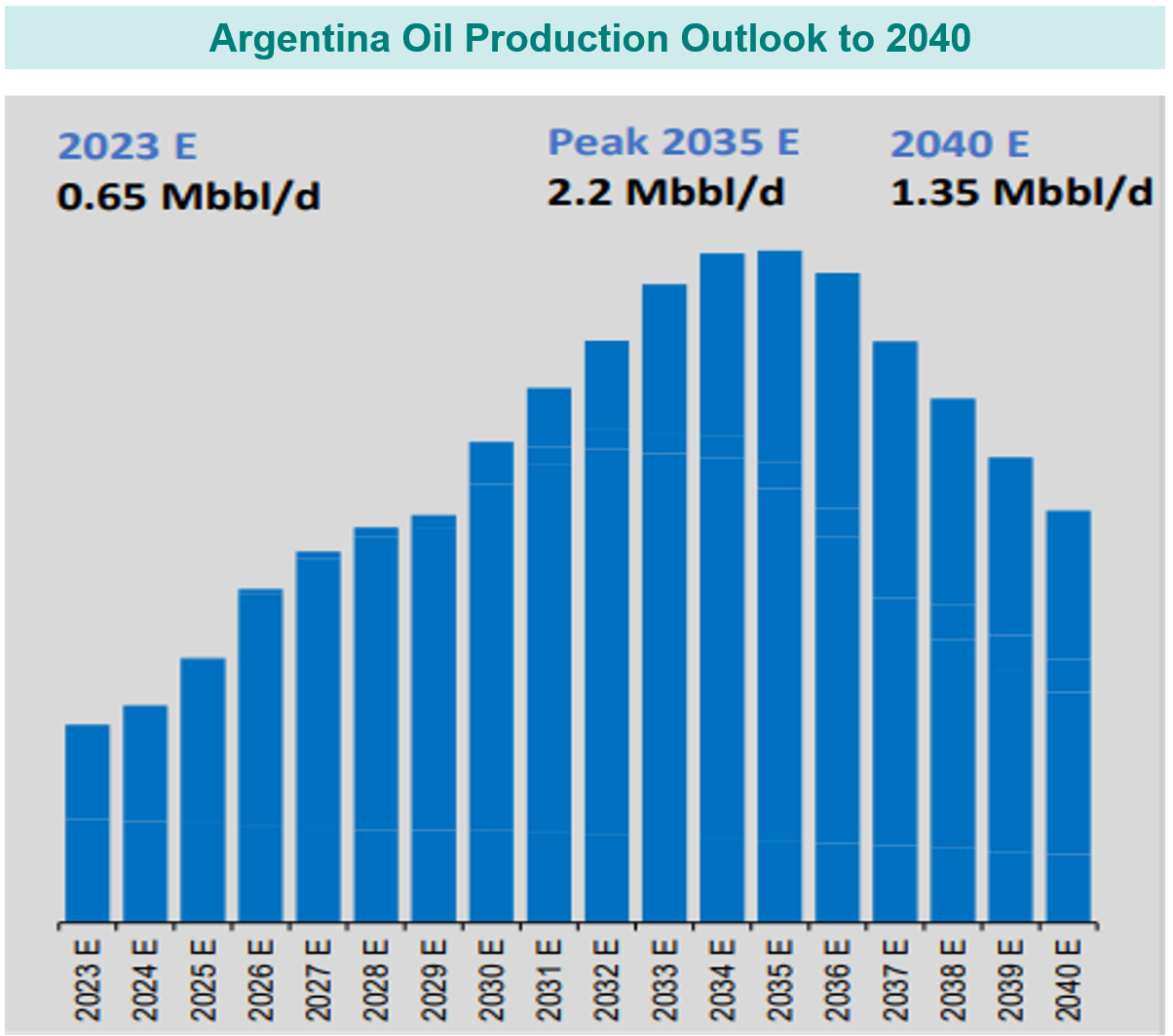

Whilst we are in ‘wait-and-see’ mode with regard to the broader Argentinian economy, we continue to have high conviction in the potential of its oil and gas sector. Regardless of who is leading the country, hydrocarbons are seen by all parties as Argentina’s main get out of jail card. The country is home to Vaca Muerta, the world’s largest shale oil and gas deposit outside the US. The basin boasts extremely attractive economics, with prolific output as well as low lifting and development costs resulting in an estimated Internal Rate of Return of close to 80% for each additional well.

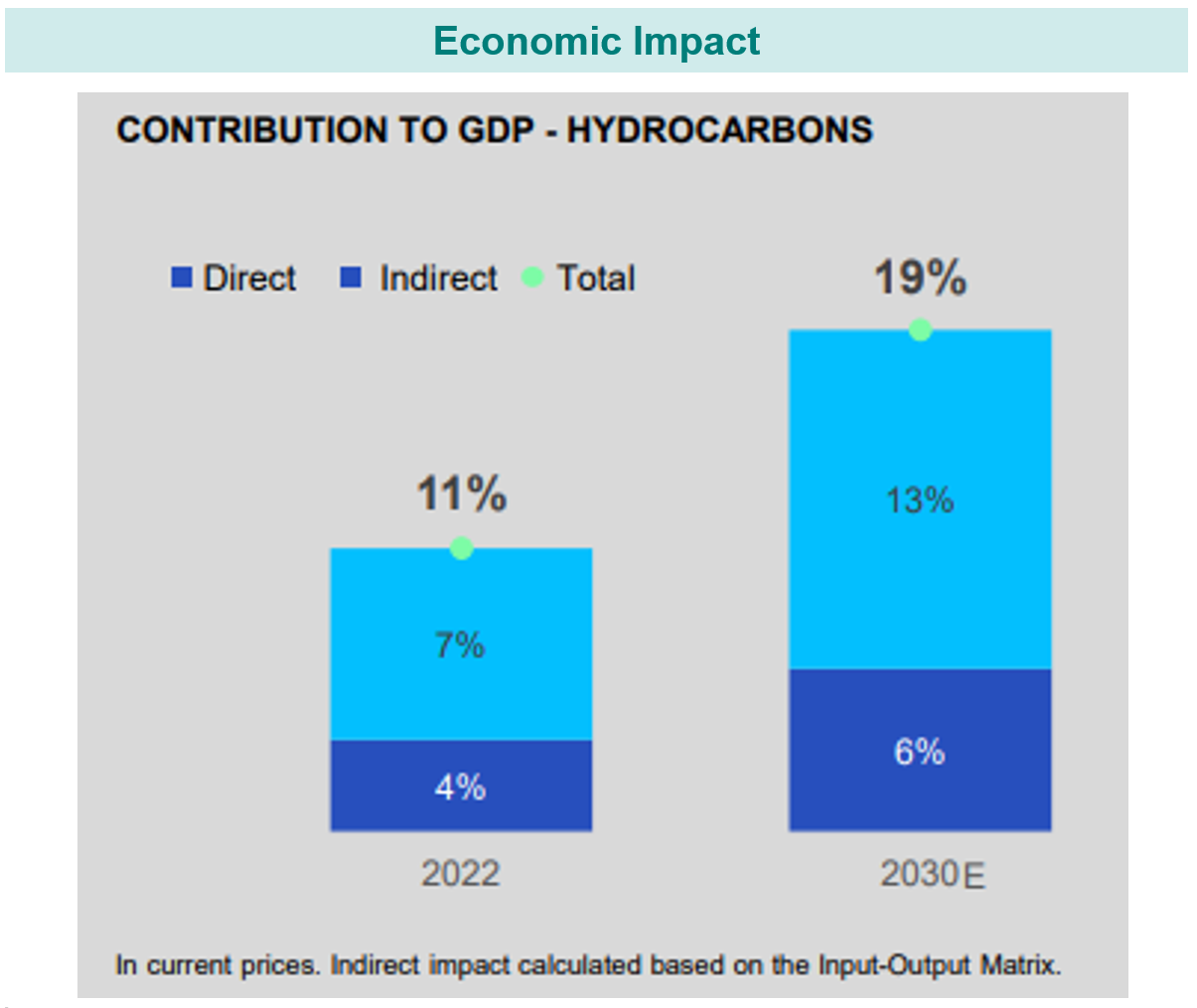

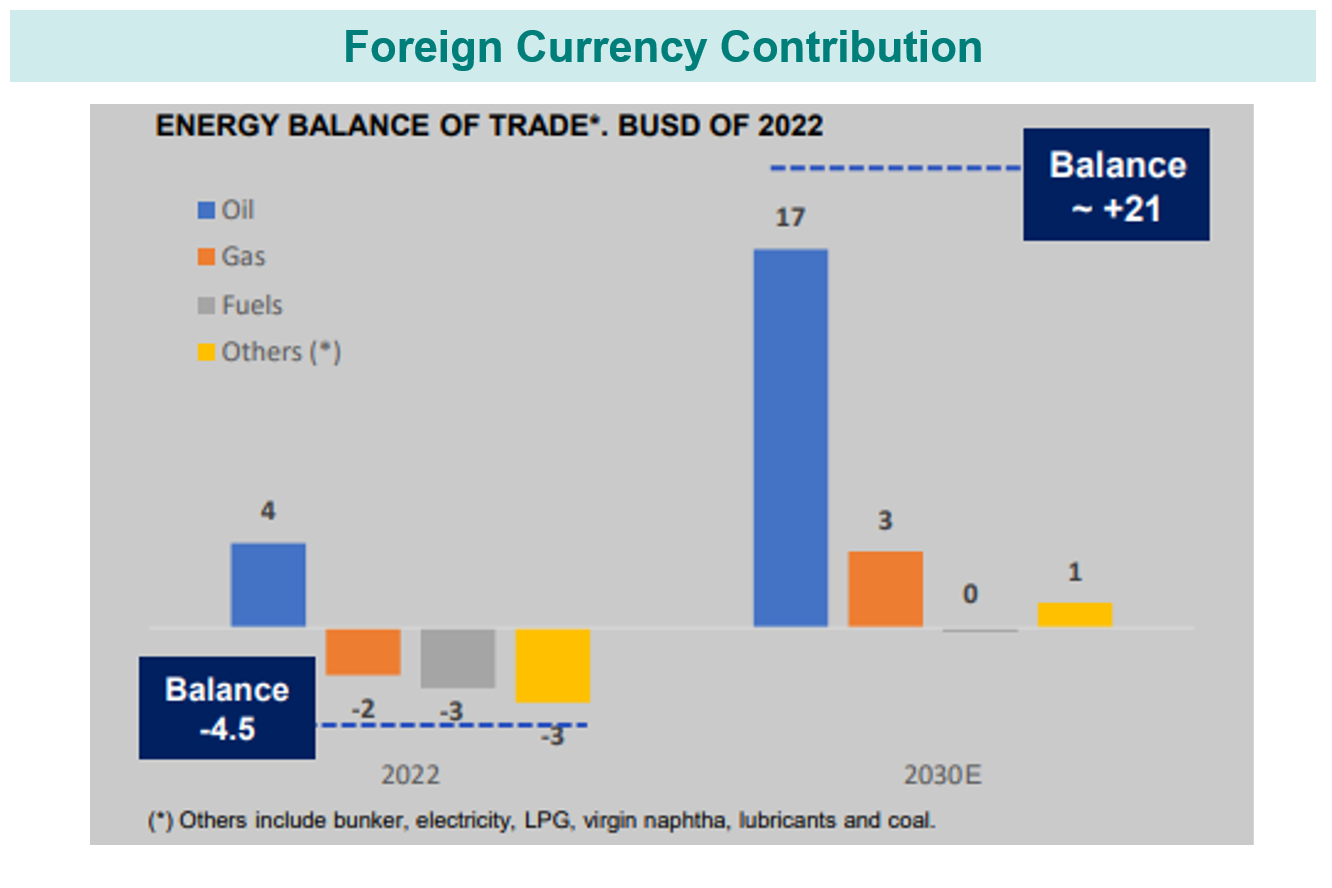

Developing this world-class asset should result in record oil production for Argentina over the next decade. In 2022 the Oil & Gas sector (direct and indirect) accounted for 11% of GDP, which is anticipated to rise to 19% by 2030. Meanwhile, the country’s energy balance of trade is expected to inflect from a $5bn deficit in 2022 to a $20-25bn surplus by 2030. This should enable the country to move to a current account surplus, which is key for economic stability.

Source: YPF (Data as at September 2023)

Source: YPF (Data as at September 2023)

Source: YPF (Data as at September 2023)

This is well understood across the political spectrum in Argentina, and unsurprisingly the sector was already being supported under the previous administration. This support may even increase under Milei’s free-market-leaning presidency as he has stated that he aims to deregulate domestic energy prices and let them converge with export parity, while privatising oil producer YPF.

We have owned Argentinian oil stocks for some time, given the scale of the opportunity at Vaca Muerta and the alignment of interests between oil producers and government. Of course, even with tailwinds as strong as these, oil stocks would struggle to outperform if the price of oil fell substantially. Although there is likely to be a degree of demand weakness as the global economy slows, OPEC+ has shown far more discipline in recent years, constraining output to keep the price of oil elevated. Amid such extended production cuts, we expect the price of oil to remain rangebound around current levels.

We hope that you found this macro outlook useful and interesting. If you have any questions or would like to hear more, please get in touch with your local relationship manager using the contact details below.

Important information: This document is issued by TT International Asset Management Ltd (“TT”), authorised and regulated in the United Kingdom by the Financial Conduct Authority. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. The circulation of this document is restricted to professional investors as defined in the legislation of the jurisdiction where this information is received. No representation is made as to the accuracy or completeness of any information contained herein, and the recipient accepts all risk in relying on this information for any purpose whatsoever. Without prejudice to the foregoing, any views expressed herein are the opinions of TT as of the date on which this document has been prepared and are subject to change at any time without notice. TT does not undertake to update this information. Any forward-looking statements herein are inherently subject to material business, economic and competitive risks and uncertainties, many of which are beyond TT’s control and are subject to change. The information herein does not constitute an offer of shares or units in any fund, and it is not an offer to, or solicitation of, any potential clients or investors for the provision by TT of investment management, advisory or any other comparable or related services. No statement in this document is or should be construed as investment, legal, or tax advice, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations. This document expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient. Any person considering any investment should consult the offering documentation if and when is made available. Investments carries with it a high degree of risk. Past performance is not necessarily indicative of future results and investors may not retrieve their original investment.