Datacentres are not a new phenomenon - the world has been seeing rapid growth in the deployment of datacentres for many years. But more recently this growth rate has been accelerating due to the adoption of AI, with strong growth expected to continue for many years to come. This has widespread implications for the environment, for economies and for equities, including our environmental universe.

So how does this affect environmental equities?

Datacentres are extremely power-hungry, and are becoming increasingly so with the latest generation of AI GPU servers, which consume significantly more power than regular servers. There is no doubt that datacentres come with an environmental cost, and the acceleration in datacentre capacity, and the associated growth in power demand, is exacerbating this cost. Since we believe this growth is inevitable, solutions that mitigate the environmental impact are potentially investable for TT’s Environmental Solutions Fund. But over-and above seeking ways to minimise the environmental cost of datacentres, for example by improving their power efficiency, more broadly there are wide-reaching implications and opportunities for many areas of the environmental universe when we investigate where this incremental power is coming from and what this means for existing electrification themes.

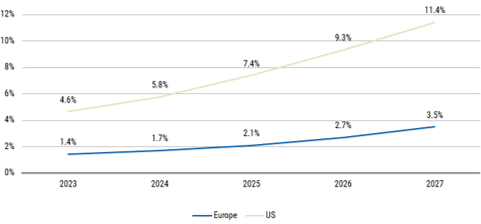

One area of relevance for environmental equities is the increased demand for renewable power and associated storage. There is a wide range of estimates for where datacentre power demand will go to, with much of the debate focussing on potential limitations such as planning and grid access & capability, rather than the undoubted demand. However, it is clear that this is a material incremental growth driver of power demand in certain geographies. The chart below shows Morgan Stanley’s estimates of the growth in power demand from datacentres in the US and Europe (shown as a percentage of 2022 total power consumption). This highlights the sharp acceleration expected in the next few years, with the percentage increasing 2.5x times from 2023 to 2027 in both regions, with datacentres accounting for 11.4% and 3.5% of power demand in the US and Europe respectively by 2027, with expectations for it to be much higher still by the end of the decade.

Data Centre Power as % of 2022 power

Source: Morgan Stanley

This increase in power demand from datacentres has particular relevance for renewables. The largest hyperscalers, including Microsoft and Google, who are responsible for much of the acceleration in datacentre deployment are doing so within the framework of their own demanding sustainability commitments, and against a broader backdrop of growing pressure for sustainably powered datacentres for all operators given increasing awareness of the environmental challenge presented by datacentres. As such, a significant portion of incremental power demand from datacentres will need to be satisfied from renewable power sources. This is leading to an acceleration of demand for many forms of renewable energy. The recent announcements by the big hyperscalers regarding nuclear and geothermal have grabbed the headlines, notably with the recent announcement that a nuclear reactor at Three Mile Island is being restarted in 2028 to supply Microsoft with power for its datacentres at an implied power price significantly above prevailing market rates. But we are also seeing signs of a pick-up in demand for wind & solar PPAs, again at premium prices. Indeed, we have examples of portfolio holdings that can already evidence this, with one of the hyperscalers recently signing a PPA for a solar asset in Ireland owned by Greencoat Renewables at a price substantially above the market power price.

This increased demand for, and therefore pricing of, renewable power has wide ranging implications. Owners of renewable assets will likely see upward pressure on the value of these assets, whilst developers will start to enjoy better economics and returns from developing renewable projects. This in turn should drive an acceleration in operating conditions for companies all the way through the renewable value chain. The fund owns several companies exposed to this dynamic in our Clean Energy segment, which is one of our seven core themes.

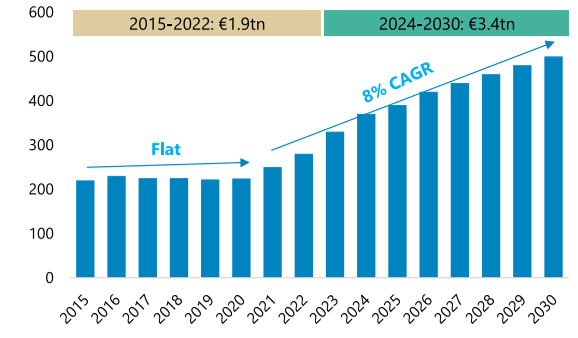

More broadly the growth in demand for power will further accelerate positive trends within electrification themes. Electrification, Energy & Industrial Efficiency is another of our core themes, and within this we have significant exposure to Electrification. Key to this theme is that in order to enable economies to increasingly electrify, there are numerous bottlenecks that need to be unlocked and significant investment that is required in electrical infrastructure. Much of the world’s grid infrastructure is aging and in need of a substantial increase in investment to make it capable of meeting the growth in electrical power demand. The chart below from a recent report by Jefferies highlights the extent of the step change in investment in power grids required to meet net zero targets, and indeed we are seeing this already happen as grid companies are committing to, and raising capital for, very significant capex increases. The chart shows that pre-2021, global grid investment was running at c. e200bn p.a. Last year this had stepped up to over e300bn but is set to accelerate to a run rate of e500bn+ by 2030 if we are to remain on track to meet net zero ambitions.

Global investments in power grids need to double to over €3.4tn between now and 2030 to remain on track with net zero ambitions:

Source: Rystad Energy, Jefferies Cap Goods Team Estimates

This step-up in investment is a powerful driver for the grid companies themselves, but also a significant growth driver for companies that supply electrical equipment & services into the grid and the broader electrical infrastructure market, many of which we have exposure to in the fund, including Nexans, Hubbell, Nvent and Nari. We also own Legrand, which not only is a supplier of electrical equipment generally, and therefore a beneficiary of broad electrification trends, but also has specific direct exposure to datacentres which currently accounts for c. 15% of sales, and we believe the exposure to this growth sector is under-appreciated and under-valued.

Another key area of relevance for environmental investing is looking at ways to improve the energy efficiency of datacentres and thereby reduce their environmental impact, as referenced earlier. One area that offers a lot of opportunity here is in the field of datacentre cooling. The energy consumed in the process of cooling datacentres can be a very significant part (up to 40%) of the overall energy consumption of a datacentre, so more energy efficient cooling solutions can have a significant impact, and increasingly so as AI servers generate significantly more heat than traditional servers.

Currently the vast majority of datacentres are cooled using Air Cooling, though there is an emerging but fast-growing trend towards liquid cooling. Liquid cooling solutions are more expensive to implement than air cooling solutions, but they are much more energy efficient, as liquids have much higher thermal transfer properties than air. As a measure of this we can compare the Power Usage Effectiveness (PUE), which is a metric to measure overall datacentre energy efficiency, and is calculated by expressing the total energy used by datacentre as a factor of the energy used just by the IT equipment. Traditional air cooling can have a PUE as high as 1.5, whereas liquid cooling technologies (Direct-to-chip, Immersion and Rear-Door Heat Exchange) can have PUE ratios of much closer to 1.0. So, there are very significant percentage savings to be made in power consumption and the payback for the higher implementation cost comes down as the amount of power being used increases. Liquid cooling solutions can also offer better space efficiency, offering further financial and environmental benefits compared to air cooled datacentres.

Current penetration of liquid cooling is very low, but as we are seeing sharp increases in the energy intensity of datacentres, we are beginning to see rapid adoption of liquid cooling technologies, with the market growing at triple the rate of traditional cooling solutions, and industry commentators believe that penetration could reach 25% by 2028. We own NVent in the portfolio which is a leader in liquid cooling technologies, offering solutions across direct-to-chip and rear-door liquid cooling. Data Solutions is currently c. 15% of group revenues, but we expect this to grow to be > 30% of group revenues in the mid-term.

In addition to the above, we also have other names in the portfolio that are positively exposed to the rapid growth in datacentres and AI. Kingspan, the insulation company, has a Data & Flooring division where the significant majority of the business provides products for datacentres, including raised access floors and suspended ceilings, as well as Hot Aisle Containment (HAC) solutions which enhance energy efficiency. At its recent half year results, the company guided for continued rapid growth in this business, with this division expected to be making e200m of trading profit in 3 years, which would be a fourfold increase from 2023, with all the growth coming from datacentres, and at that point would represent c. 15% of group profit.

Another example is Chroma, a Taiwanese listed stock, which also has exposure to growth in datacentres and AI related spending, although this is not the primary driver for inclusion in the fund, which is its crucial role in EV and battery testing. Their semiconductor related revenues accounted for 16% of group revenue in 2023 but due to over 100% year-on-year growth this year will account for approximately a third of group revenues in 2024. One of the key drivers of this growth is Chroma’s AI system level test (AI SLT) related revenues. These tools are used to assess the performance, robustness, and reliability of AI applications, ensuring they meet industry standards and function effectively in real world scenarios. Volume growth at key customer Nvidia, ASP increases for their tools, and longer testing times leading to a greater demand for tools are all driving Chroma’s strong growth in this area. These drivers will support continued growth over the medium term as well as the potential of additional growth from the broadening their customer base.

The rapid growth in datacentres, accelerated by AI, is a trend we expect to continue for the foreseeable future. Whilst being very mindful of the environmental cost of the datacentre industry, we also believe that this growth is inevitable, and therefore if we can identify companies that are mitigating this cost, as indeed we have, then those are potential investment opportunities. In addition to this, we also believe that the growth in datacentres & AI more broadly is supportive to many of the themes within our investment universe, and that many investments in our fund are beneficiaries of this trend.

Important information: This information is issued by TT International Asset Management Ltd (“TT”), authorised and regulated in the United Kingdom by the Financial Conduct Authority. This information is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. The circulation of this information is restricted to professional investors as defined in the legislation of the jurisdiction where this information is received. No representation is made as to the accuracy or completeness of any information contained herein, and the recipient accepts all risk in relying on this information for any purpose whatsoever. Without prejudice to the foregoing, any views expressed herein are the opinions of TT as of the date on which this information has been prepared and are subject to change at any time without notice. TT does not undertake to update this information. Any forward-looking statements herein are inherently subject to material business, economic and competitive risks and uncertainties, many of which are beyond TT’s control and are subject to change. The information herein does not constitute an offer of shares or units in any fund, and it is not an offer to, or solicitation of, any potential clients or investors for the provision by TT of investment management, advisory or any other comparable or related services. No statement in this information is or should be construed as investment, legal, or tax advice, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations. This information expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient. Any person considering any investment should consult the offering documentation if and when is made available. Investments carries with it a high degree of risk. Past performance is not necessarily indicative of future results and investors may not retrieve their original investment.