We discuss the strategy’s genesis, objectives and key differentiators, before outlining why we find environmental equities so exciting looking forward.

Genesis

The primary reason for launching the strategy in May 2020 was to help tackle the two greatest challenges facing our planet: climate change and biodiversity loss. We are often bombarded with statistics about these unfolding disasters to the point where we become desensitised to their meaning, particularly when the differences between degrees of planetary warming often seem trivial – one, two, four, five. Human experience and memory simply have no frame of reference for how we should comprehend these figures. Based on existing nationally adopted policies, global temperatures are forecast to rise by between 2.1 and 3.9 degrees by the end of the century. Even assuming a full implementation of the ambitious Paris Agreement pledges, end of century warming is estimated to be between 1.9 and 3.0 degrees1.

To put this in a human context, at two degrees of warming, the ice sheets will begin to collapse2, eventually flooding more than 100 cities around the world, from Miami to Hong Kong3. 400 million more people will be blighted by water scarcity4, and major cities in the planet’s equatorial band will be rendered uninhabitable. At three degrees, Southern Europe would be in permanent drought, and the average drought in Central America would last 19 months longer5. 99% of Australia’s coral reefs would be lost, and extreme wildfire days could increase by 300%6. This would mean that most seasons would resemble the recent Black Summer bushfires, which blanketed cities in smoke for months and killed or displaced 3 billion creatures in the single biggest wildlife catastrophe in recorded history. At four degrees, there would be almost annual global food crises7, and the influence of climate on armed conflicts would increase more than five times8. Damage to the global economy would total over $23 trillion per year, or the equivalent of three to four Great Recessions annually9.

The biodiversity crisis typically attracts less attention, but is no less pervasive; only 3% of the world’s ecosystems remain in pristine condition10. Perhaps unsurprisingly then, we are now at the start of a sixth mass extinction, with the rapid loss of species being seen today estimated to be up to 10,000 times higher than the natural extinction rate11.

We believe that the finance industry has an obligation to come up with more radical solutions to tackle these existential threats. When we analysed existing products on the market, we felt that many climate/transition funds were failing to direct capital towards companies that are actually creating the solutions to environmental problems. Instead, many seemed to be proxy technology funds with top holdings such as Amazon or Facebook, investing in companies that simply have low carbon scores, not because this is the key to solving environmental crises, but because it is an easy metric to measure and therefore commercialise. Crucially from an investment perspective, we also believe that environmental equities represent the biggest structural growth opportunity of the next generation. As a species we need to fundamentally change the way we generate energy, travel, grow our food, clothe ourselves, and construct our buildings. There is a revolution coming over the next 30 years that will touch every single company in the world to some degree.

Aims and key features

With this in mind, the key aims of the TT Environmental Solutions strategy are to generate strong long-term returns by investing in the leading global structural growth theme, and to drive capital towards companies that are delivering the green transition and protecting against biodiversity loss. It also aims to directly benefit the environment as one-third of all management fees are donated to a select number of environmental charities.

We believe the following attributes truly set the strategy apart from the competition:

Pure-play environmental strategy

Firstly, it is a pure-play environmental strategy with a high hurdle for inclusion. We demand the highest level of environmental standards from all our portfolio holdings. The fund aims to have at least 80% of invested capital in companies where the majority of revenues or profits stem from tackling a specific environmental problem, and all holdings must be making significant contributions to environmental solutions. At the core of our process is a proprietary 5-step environmental screen that we use to assess whether companies are legitimately providing environmental solutions, and therefore whether they qualify for potential inclusion in the fund. We believe that our definition of ‘environmental solutions’ is significantly more stringent than many of our peers.

Innovative fee structure

While our investment process is specifically designed to drive capital towards companies that are helping to mitigate environmental problems, our innovative fee structure is intended to provide even greater impact. One-third of our management fees are given to environmental charities that combat climate change and biodiversity loss, with our current chosen partners being a charity that plants trees and one that ‘rewilds’ habitats. Indeed, when creating the product we wanted to ensure that it had a genuine tangible benefit to the environment by supporting carefully selected charities, and also that our support for these charities would increase materially as the product scaled up. But our relationship with these charities goes beyond simple donations. We look to form holistic and meaningful partnerships with them, sharing expertise wherever possible. For example, Deputy Portfolio Manager Ross Sterling sits on a committee created by ‘rewilding’ charity Heal to advise them on their capital structure. Meanwhile, Co-Portfolio Manager Harry Thomas is in regular dialogue with various representatives of our chosen charities to exchange advice and connect them to influential people that may help their cause. We are happy to give time as well as money, leveraging our expertise and connections to foster more valuable relationships with these charities than donations alone ever could.

Research Advisory Board

Given the portfolio’s environmental focus, a Research Advisory Board consisting of world-renowned experts in the fields of green policy, green technology, ecology and green finance has been assembled to assist the team in the following areas:

- Provide insights from their fields of expertise.

- Challenge the investment team on portfolio holdings with regard to the fund’s environmental objectives.

- Ensure engagement with companies is comprehensive and covers the key topics.

The board consists of:

- Dr Ma Jun – a key green policy adviser in China and Co-Chair of the G20 Green Finance Study Group.

- James Brown – responsible for building a European and North American offshore wind project pipeline for Hexicon, a world leader in floating offshore wind technology.

- Dr Joseph Bull – senior lecturer in Conservation Science at the University of Kent.

- Karen McClellan – advisor, board member and investor in clean tech companies and Emerging Markets clean energy projects.

The investment team are well aware that their skillset and experience are highly specialised, with their focus being primarily on equity markets. Consequently, they find the significant breadth and depth of additional expertise offered by the board to be invaluable in helping their analysis evolve with the rapidly changing regulatory and technological backdrop, both in terms of scrutinising a company’s environmental credentials and identifying new opportunities.

Genuinely global approach

Moreover, this is a genuinely global approach. Whereas many of our competitors have portfolios that are dominated by companies in Europe and the US, our world-class team of analysts have many years of experience researching companies across the globe, including in Emerging Markets, where TT has a market-leading strategy. Consequently, our portfolio contains numerous exciting companies in Asia and Latin America.

This is important as many cutting-edge environmental technologies are being developed in Emerging Markets. For example, Korea produces two-thirds of the world’s battery cells, which means that much of the battery materials supply chain is also being localised in the country. It is also at the forefront of hydrogen fuel cell and floating offshore wind technology. Elsewhere, China is driving much of the environmental transition through policies that are stimulating the renewables build out and electric vehicle adoption; it is looking to put 1m hydrogen fuel cell vehicles on the road by 2030. Taiwan meanwhile, by virtue of its leading expertise in the semiconductor and electronics industries, is a key beneficiary of the electrification of the planet. If you were to distil the green transition into its simplest form, it is essentially a shift from hydrocarbon molecules – coal, gas and oil – to electrons. Taiwan is home to numerous companies in the supply chains for the electrification of homes and vehicles. As such, its economy is one of the most geared to the accelerating shift towards electrification.

Not only are some of the most exciting new environmental technologies being developed in Emerging Markets, but also many of the world’s most valuable renewable energy resources are located in the global south. Whether it’s onshore wind in Brazil that blows as fast as offshore wind in the northern hemisphere, or first-class solar resources in South Africa and India, Emerging Markets have a huge abundance of natural resources to equip them for the energy transition. Crucially, many of these countries also have immature energy infrastructure networks. This means that they have an enormous opportunity to skip a level of development when they are building out their networks, bypassing many of the traditional hydrocarbon-heavy layers, and moving straight to distributed renewable energy and hydrogen. For these reasons, we believe that Emerging Markets should be a large portion of an environmentally focused portfolio.

Diversified thematic exposure

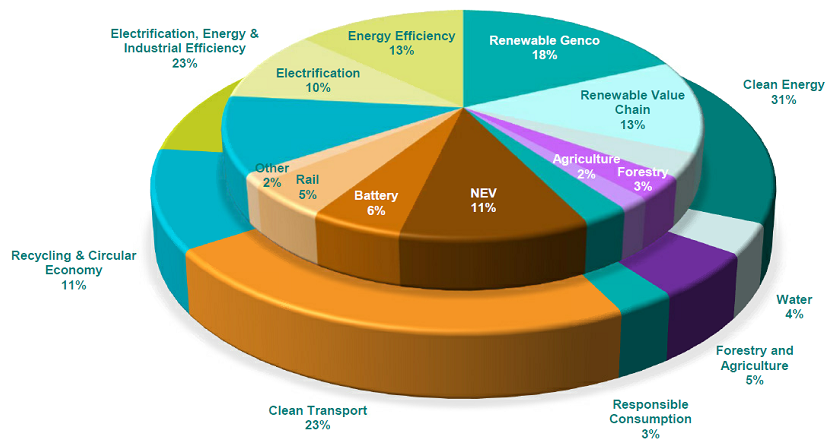

Similarly, whereas many of our competitors have a narrow focus on carbon and electrification, our portfolio has a far wider diversification of thematic exposure, recognising that the green transition will impact a huge number of areas, including energy generation, travel, building, diet, agriculture and clothing. Many of these themes remain significantly underappreciated by the market in our view. The portfolio’s current thematic exposure can be seen below:

Data as at 30th April 2021.

Importantly, exposure to these thematics is fluid and will vary over time according to the prevailing opportunity set. There may be times when we have zero exposure to certain themes if they are deemed to be unattractive at a given point in time. We believe that such diverse exposure can enhance the risk-adjusted returns of the portfolio, protecting it during periods when many of the more expensive renewables companies correct, as they did recently when a spike in US bond yields catalysed a sharp sell-off in ‘growth’ stocks.

The continued case for environmental equities

2020 was undoubtedly the year that environmental investing came of age. Partly in response to the global pandemic, governments around the world announced truly vast support packages worth trillions of dollars to help facilitate the green transition. This catalysed significant outperformance of ESG/sustainability as a general thematic, and particularly of environmental equities. Much of the outperformance over the past year has been driven by a re-rating of stocks rather than earnings growth, and clearly such a re-rating cannot continue in perpetuity. That said, while there has been a significant re-rating of well known, liquid names in Europe such as Vestas and Ørsted, as well as many renewables/EV companies in China, beyond these popular pockets of the market we continue to find environmental solutions companies that we believe have excellent products and opportunity sets, but which haven’t yet enjoyed nearly the same magnitude of stock performance.

Even accounting for the material short-term re-rating that some companies in the space have enjoyed, we still believe that environmental equities are incredibly exciting because they offer an opportunity to invest in companies that can grow and compound revenues at very high rates for a prolonged period of time. There are many areas in our investment universe that we believe will be 10 times bigger in 10 years’ time, including electric vehicles, solar and wind power, but there are also areas that could realistically be 100 times or even 1000 times bigger, including carbon capture, hydrogen, lab cultured meats and recycled clothing. In our view, investing in these disruptive, high-growth industries with huge addressable markets offers an unparalleled opportunity to generate substantial long-term returns.

Sources:

1. https://climateactiontracker.org/publications/global-update-climate-summit-momentum/

2. Alexander Nauels et al., “Linking Sea Level Rise and Socioeconomic Indicators Under the Shared Socioeconomic Pathways,” Environmental Research Letters 12, no. 11 (October 2017)

3. https://nsidc.org/cryosphere/quickfacts/icesheets.html

4. https://interactive.carbonbrief.org/impacts-climate-change-one-point-five-degrees-two-degrees/ It is estimated that a total collapse of the ice sheets would raise sea levels by over 200 feet, but a much smaller rise would be required to flood many cities. Miami sits 6 feet above sea level, while parts of Hong Kong are at sea level. In fact, two-thirds of the world’s biggest cities are within a few feet of sea level.

5. https://interactive.carbonbrief.org/impacts-climate-change-one-point-five-degrees-two-degrees/

7. David Wallace-Wells, The Uninhabitable Earth A Story of the Future, 2019

8. https://news.stanford.edu/2019/06/12/climate-change-cause-armed-conflict/

9. https://phys.org/news/2018-08-trillion-lost-temperatures-degrees.html

10. https://www.frontiersin.org/articles/10.3389/ffgc.2021.626635/full

11. https://wwf.panda.org/discover/our_focus/biodiversity/biodiversity/

Nothing in this document constitutes or should be treated as investment advice or an offer to buy or sell any security or other investment. TT is authorised and regulated in the United Kingdom by the Financial Conduct Authority (FCA).