Taking stock after an incredibly volatile first half of the year, we discuss the trends that we see ahead in the global economy, paying particular attention to the opportunities and threats for Emerging Markets.

As we reach the halfway point in 2020, who would have thought at the start of the year that we would be living through the largest economic contraction that the US has seen for nearly a century? Likewise, who could have predicted that the UK economy would shrink over 20% in April, compared with a peak-to-trough contraction of ‘just’ -6.2% during the Global Financial Crisis (GFC)? These painful stories are playing out across the world, and unemployment rates are skyrocketing as a result.

Yet there is plenty of scope for optimism. Governments and central banks around the world seem to have learned lessons from the GFC, and have been extremely proactive at throwing “whatever it takes” at their economies, whilst pinning interest rates across the world at close to zero. Indeed, economies have never in peacetime seen government spending on the scale that is now taking place. Consequently, despite the precipitous collapse in the global economy, global equities (MSCI ACWI) are down just -5.7% at the time of writing, whilst the domestic Chinese CSI index is now up 14% this year, and the US Nasdaq 100 is up 15.5% year-to-date. As the world’s adoption of video conferencing and online shopping accelerates exponentially, stock prices of key beneficiaries such as Zoom and Amazon are up 289% and 59% this year, respectively.

In this detailed note, we discuss the trends and drivers that we see ahead in the global economy, and consider, in particular, the opportunities and threats in Emerging Markets. We also highlight many issues that our clients have been asking about, including a potential second wave of Covid-19, Sino-US relations, the de-listing threat to foreign ADRs, and the outlook for Growth versus Value.

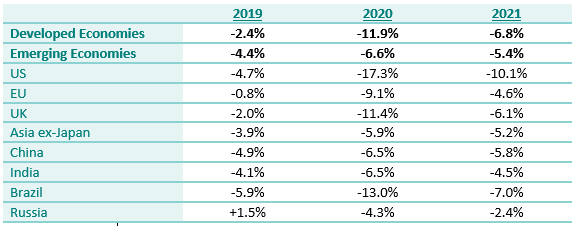

Let us start with economics. Bloomberg consensus expectations are for the developed world to contract by -6.1% in 2020, and emerging economies to contract by -0.1%. Within the developed world, the US is expected to shrink by -5.7%, the EU by -7.5%, and the UK by -8%. It should be noted that the range of outcomes predicted by economists continues to be extremely wide, with the Bank of England’s ‘illustrative scenario’ being a 14% fall in the UK economy – representing the worst performance since 1706.

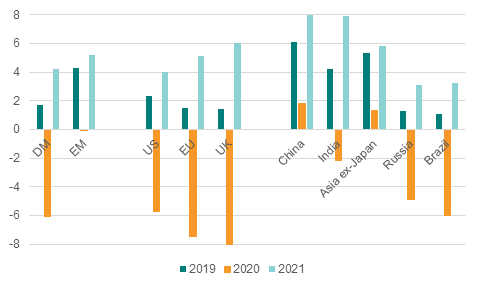

Consensus real GDP expectations

It is clear from the graph that, while economic contractions are expected to be substantially larger in developed economies than in emerging ones, the recovery in 2021 is also faster in EM. If this consensus data turns out to be accurate then, by the end of 2021, the developed world will still be 0.5% smaller than it was back in 2018. Emerging economies, on the other hand, will be 10% larger.

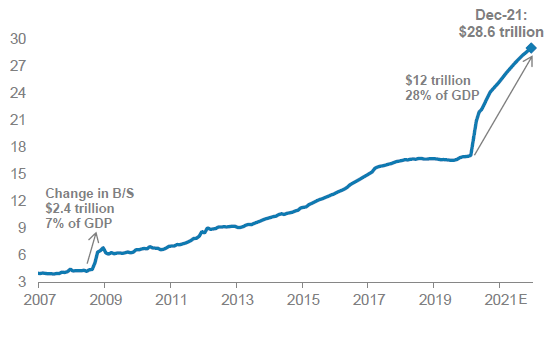

One of the most striking aspects of this crisis has been the pace and magnitude of monetary and fiscal stimulus, which far exceeds that which occurred in the GFC. It is expected that G4 balance sheets will collectively expand by approximately 28% of GDP this time around, versus a 7% expansion in 2008.

G4 central bank balance shet (USD tn)

An estimated $6-7 trillion of quantitative easing is likely to have been executed during 2020 to support asset prices and, effectively, manage the yield curves in major economies. Meanwhile, official short rates have been slashed around the world and sit close to zero in many economies.

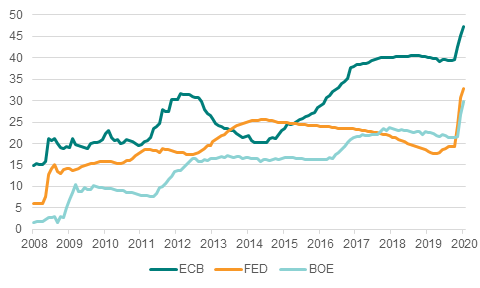

Central bank balance sheets as % of GDP

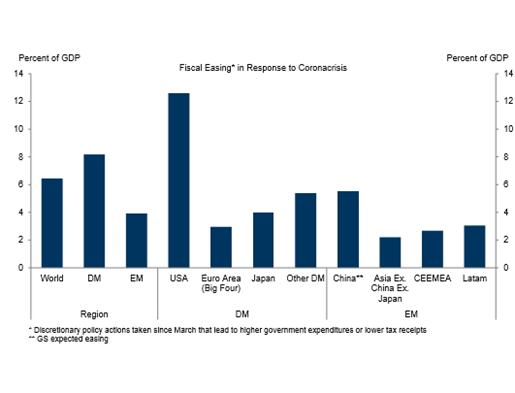

Whilst the monetary policy impetus has been massive, governments have also seemingly discarded any previous metrics of fiscal discipline, with direct financial support for businesses and individuals amounting to between 4-12% of GDP in most economies.

Discretionary fiscal easing

Fiscal deficits are ballooning as a result. The table below uses consensus data, but it is worth noting that some commentators have substantially larger numbers pencilled in.

Fiscal deficits (% of GDP)

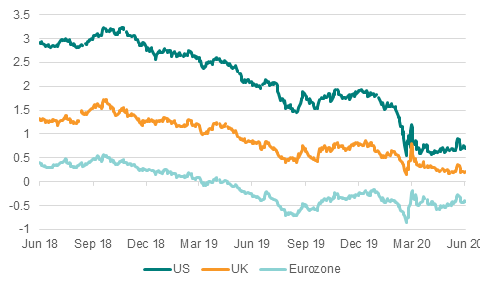

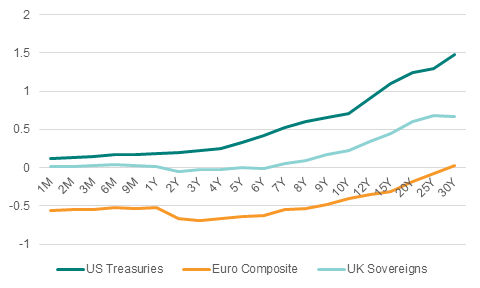

The numbers – both on the fiscal and monetary side – look set to rise further. The US appears to be planning additional stimulus of between $1-2 trillion, likely to pass through Congress by the end of July. At the same time, the ECB is proposing a €750bn European ‘Next Generation Fund’ to specifically bail out those countries and sectors hardest hit during the downturn, while the Bank of England has just announced a further £100bn of bond buying. This activity has caused interest rates to collapse and yield curves to flatten.

Bond yields have collapsed

Yield curves

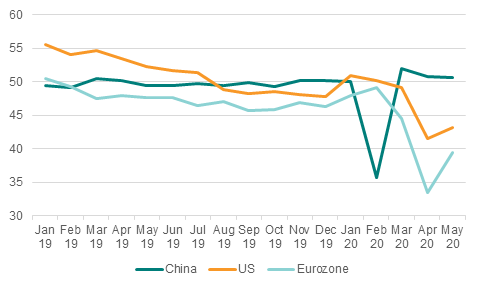

There is plenty of debate about the shape of an eventual recovery – will it resemble a ‘V’, a ‘U’, or even a ‘W’? China’s PMI data very clearly demonstrates a ‘V-shaped’ recovery. This is far less pronounced in the US and Eurozone so far, although clearly China was ‘first in, first out’ in terms of its Covid-19-related downturn.

Manufacturing PMIs

Studying the Chinese economy, there is clear evidence that manufacturing has substantially returned to pre-Covid-19 levels, or indeed even higher, with the domestic economy now having largely reopened. Consumption seems to be slower in returning to previous levels, but does appear to be on the right trajectory, with some particularly bright spots such as auto sales.

Chinese auto sales

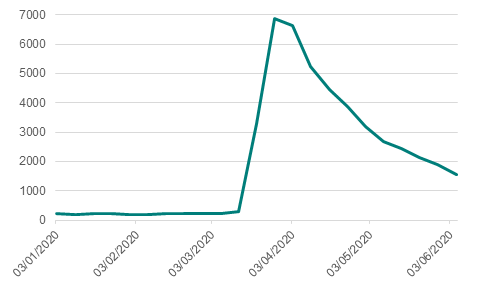

As western economies begin to open up in a phased manner, there would also appear to be evidence of a nascent rebound. US unemployment data is one such metric showing a clear improvement, albeit after an unprecedented initial spike.

US initial jobless claims (x1000)

Of course, the shape of a global recovery depends on whether or not governments have relaxed the lockdowns too soon before a vaccine is ready. Given that we do not know the answer to this yet, it is difficult to have a high degree of confidence in the economic situation over the coming 9-12 months, and this uncertainty is manifest in our balanced portfolio positioning. A widely available vaccine by year-end would be a very positive backdrop for risk assets and would likely result in a V-shaped recovery. Conversely, if this eludes us until well into 2021, then a full economic recovery is more likely to be W-shaped.

Turning to Sino-US relations, there can be little doubt that they are strained and are unlikely to improve materially. Ultimately, Chinese economic expansion is perceived to be a threat to US dominance, and that conflict of interests is not going to abate. Increasingly the world will be dominated by these two huge economies. Any economic sanctions will merely act as a drag on growth for all, and not materially change this shift in the balance of power. President Trump, of course, has a close eye on the Presidential election, where the latest polls put him behind Joe Biden. Being seen to be tough on China would appear to be a vote winner that both Republicans and Democrats are keen to court. On the other hand, any action that threatens the recovery in the US economy might jeopardise Trump’s chances of re-election. If being tough on China does not result in the desired pick-up in Trump’s popularity, then it is unclear whether he will double down and get more extreme, or choose to back off.

China has longer-term aspirations to be the largest economy in the world. It also aims to ensure that it is not reliant upon the West – particularly the US – in any regard, notably technology, energy and food. Its technological capabilities have expanded rapidly in the last decade and its realistic aim is to be amongst the best in the world in this regard. If China can continue to generate strong economic growth (notwithstanding the Covid-19 hit to 2020 GDP), then it can maintain a firm hold over its people. Historically, China has had little desire for military ‘empire building’. Taiwan and Hong Kong are sometimes cited as exceptions to this, but they are perceived in Beijing to have been Chinese all along. Of course, as China’s economic and military strength grows, it is less likely to tolerate Western ‘interference’ in its sphere of influence, such as the South China Sea. This will almost inevitably lead to increasing tension with the West, especially the US, in the coming years.

The new security law that the Chinese government has decided to impose on Hong Kong is clearly a backwards step for Hong Kong’s autonomy, but not entirely surprising as President Xi wishes to tighten up national security. We see this as the next stage in Beijing’s long-term plan to slowly re-absorb Hong Kong into China. The ‘one country, two systems’ approach is useful to China and the recent removal of the preferential trade terms which Hong Kong currently enjoys is certainly a blow. The new security measures may well influence decisions in Europe and the UK about using Huawei technology in 5G infrastructure, and will likely hasten the transition to a model whereby the West will increasingly use US/European technology, whilst much of Asia will be more China-centric and aim to rely less on Western tech.

Foreign investment into China may also be vulnerable in the future if Sino-US relations continue to deteriorate. Recent threats in the US to force a tightening of reporting standards for foreign ADR listings is one potential weapon in this regard. Chinese ADR companies are increasingly seeking to mitigate this risk by having secondary listings in Hong Kong, following Alibaba’s lead last year. JD.com and NetEase are two of the latest high profile examples. Although this is disruptive, especially for smaller Chinese ADR stocks, we do not expect it to materially affect portfolio flows into China and Hong Kong. Paradoxically, it may in fact act as support for the Hong Kong dollar as flows are re-routed via new Hong Kong-listed stocks.

There is an almighty battle raging in equity markets between unprecedented policy easing on the one hand, and a collapse in the global economy and corporate earnings on the other. With Developed Market valuations at elevated levels versus history, particularly in the US, it is clear that liquidity is winning this battle. In addition to ongoing policy impetus, major economies also continue to be unlocked, despite localised second waves of infections. In our view, this favourable combination tips the balance towards equity markets trending higher. Key developments to keep a close eye on are the rate of change in Covid-19 cases, and the speed at which an effective vaccine is produced and distributed worldwide. In the longer term, the key to market direction will be the speed at which accommodative policy is reversed. In 2011, the President of the ECB, Jean-Claude Trichet, made the mistake of raising official interest rates before a recovery was sufficiently under way. Our expectation is that central bankers across the world have learnt this lesson and that policy rates will not be raised for many years to come. What is more difficult to assess is whether, in the face of ballooning fiscal deficits, governments will be tempted to tighten fiscal policy too early. Our sense is that there is a greater tolerance for higher fiscal deficits and, whilst everyone is in the same situation, there is little competitive disadvantage in allowing them to remain elevated.

Several clients have suggested that, in an environment of sharply deteriorating global macro-economics, Developed Markets are a preferable home for capital than Emerging Markets. We respectfully disagree. It is certainly true that EM equity outperformance is synonymous with a ‘risk-on’ environment, and is closely related to global trade volumes, which will remain challenged as economies become more insular following the Covid-19 crisis. However, as many of the larger emerging economies have developed rapidly over the past decade, we would argue that they now have sustainable domestic demand of their own, and rather than being dominated by low margin manufacturing, they now offer increasingly value-added, high margin products and services.

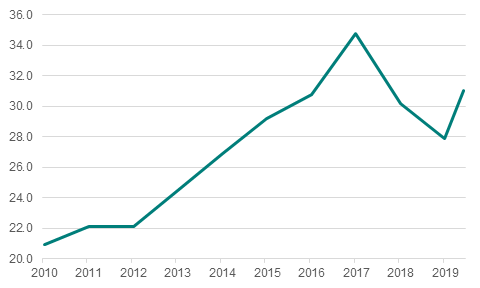

This is evidenced by the fact that the Technology component of EM equity indices has risen sharply over the past decade. Indeed, the Technology and Communication Services sectors (plus Naspers, which owns a substantial stake in Chinese internet company Tencent), now account for 31% of the MSCI EM index. While this number is still behind the 37% in the S&P composite index, it is catching up, and already far exceeds the 13% in the Euro Stoxx 50.

Technology and Communication Services weight in EM

Source: MSCI

China’s recent National People’s Congress announced a huge fiscal package which, along with traditional infrastructure and clean energy, also targets the technology industry as a key area for investment and growth over the coming years. Environmental capex is a theme that we believe will have a structural tailwind for many years to come and we are looking to specifically target it in our EM and Asian strategies.

We are firmly of the belief that international investors buy Emerging Markets largely for superior growth. In a post-Covid-19 world, with large global fiscal deficits, growth will be scarce, particularly in the developed world. When combined with near-zero interest rates for many years to come, this suggests that long-duration, growth characteristics such as those found in many technology companies will be highly sought after and justify a re-rating.

That said, valuations of many Developed Market tech stocks are already at nosebleed levels. Tesla and Zoom, trading on 134 and 175 times earnings, respectively, are cases in point. Emerging Markets offer substantial breadth and depth of technology stocks, usually trading on significant discounts to their Developed Market peers. Genuinely world-class companies such as Alibaba on 25x or Tencent on 30x earnings are good examples.

More broadly, EM equities have tended to outperform when their relative economic growth rate to DM is widening, as it is now. EMs retain a structural growth tailwind and, in many cases, have far superior demographics than their developed world counterparts. There is also a strong correlation between US dollar weakness and EM outperformance. Whilst the dollar was firm in the first 3 months of this year, it peaked in March and has since weakened. Although we do not anticipate a sharp fall, we would expect it to continue to drift lower due to the combination of a weaker economy, lack of interest rate support, substantial monetary easing, and the uncertainty of a Presidential election ahead. In contrast to the dollar, some EM currencies such as the Brazilian real, South African rand and Russian ruble have recently had a strong bounce after being hit hard this year. We expect them to recover further as the year progresses.

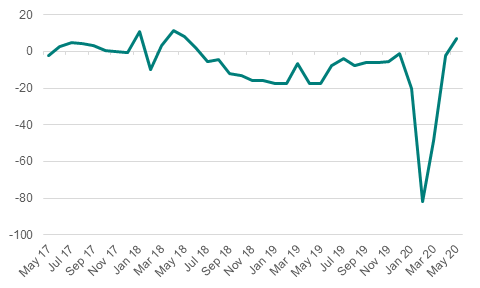

Brazilian real/US dollar

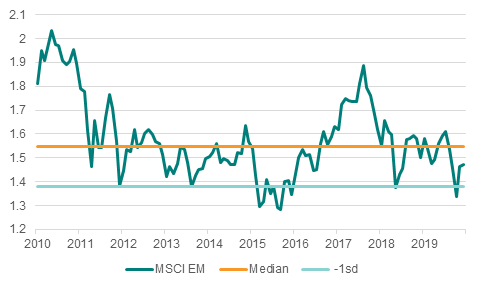

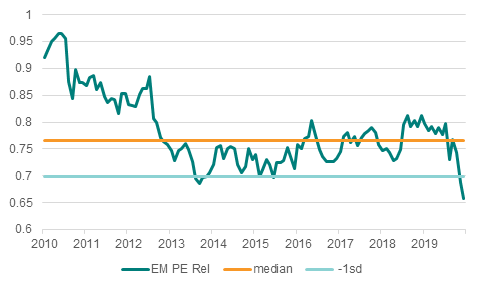

On valuation, DM equities – especially those in the US – are expensive compared to history, but may remain so for the reasons stated. In our view, EM equities offer far more comfort to investors in this regard. Whilst current EM Price/Earnings ratios are 11% ‘expensive’ versus their 10-year median (the US is 17% dear on this metric), the Price/Book ratio in EM is still 5% ‘cheap’. Moreover, EMs are 35% cheaper than DMs on a Price/Earnings basis, with a relative valuation gap that is 1.5 standard deviations below the 10-year average.

MSCI EM price/book

EM P/E relative to DM

In our view, Emerging Markets continue to offer a highly diverse universe of countries, macroeconomic characteristics and individual stocks. From a Covid-19 perspective, this universe encompasses the early entrants such as China, Korea and Taiwan, where cases are down substantially, and also the laggards such as Brazil and India, where infections continue to rise. The former provide greater certainty in this regard, while the latter have seen stock prices fall further and offer valuation and recovery potential.

We do think that technology offers multi-year structural growth opportunities in Asia, but there are also very attractive cyclical recovery ideas, both in Asia (notably China and India) and in many other Emerging Markets such as Russia and Brazil. Our EM team therefore have a balanced portfolio, which continues to target attractive undervalued growth opportunities across the EM universe, whilst not compromising on quality of management and balance sheet strength. After a strong rebound, we anticipate only modest market gains in the short-term, but expect that the environment will be conducive to alpha creation. We therefore aim to continue taking advantage of the many inefficiencies in EM equities for our clients.

Nothing in this document constitutes or should be treated as investment advice or an offer to buy or sell any security or other investment. TT is authorised and regulated in the United Kingdom by the Financial Conduct Authority (FCA).