It is well understood that China’s economy is currently undergoing a great rebalancing as it shifts towards a model of consumption-based growth. However, we believe that many investors fail to grasp the implications of this transformation, which we still see as one of the most powerful and exciting investment themes in the world today. In the piece below, we outline some of the key opportunities that have arisen from China’s ongoing evolution and explain the common mistakes made by investors attempting to profit.

As investors look around the world today, they can be in little doubt that growth is slowing. 10-year sovereign bond yields are below 10 basis points or even negative in 11/25 of the world’s largest economies. In our view, investors searching for growth need to look to Emerging Markets such as China, where there is positive inflation and powerful long-term structural trends. While China’s growth has slowed relative to its own heady standards, the reality is that it is still growing strongly compared to other major economies. Importantly, this growth is higher quality and ultimately more sustainable than it has been in the past; it is primarily driven by consumption instead of excessive borrowing to fund increasingly less productive investment.

Although

Sino-US trade tensions have hit the Chinese economy, recent newsflow suggests

that there could be some incremental improvement from here, helping to boost

confidence and supporting growth. This

seems to be substantiated by encouraging signs in the technology and

manufacturing sectors, where there is evidence of a nascent inventory rebuild.

Of course, President Trump is notoriously unpredictable and there is a risk

that the trade war escalates further. However, in this scenario we feel

comfortable that Beijing has the will and the means to offset any weakness

through various policy adjustments.

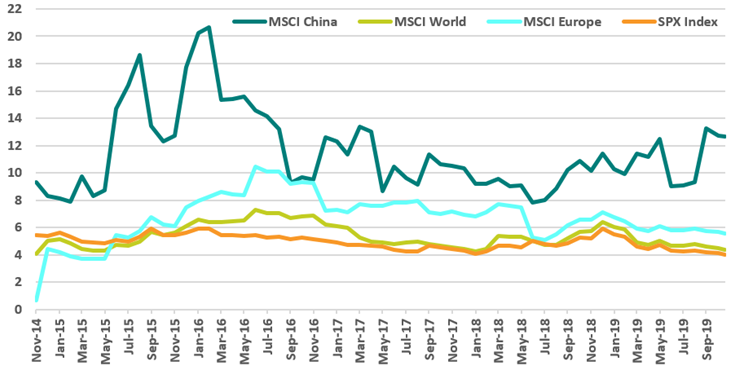

Despite China’s superior growth prospects, its equity markets trade at an attractive relative valuation. For example, China has consistently offered the highest free cash flow yield of all the major markets.

FCF Yield

Source: TT International, Bloomberg

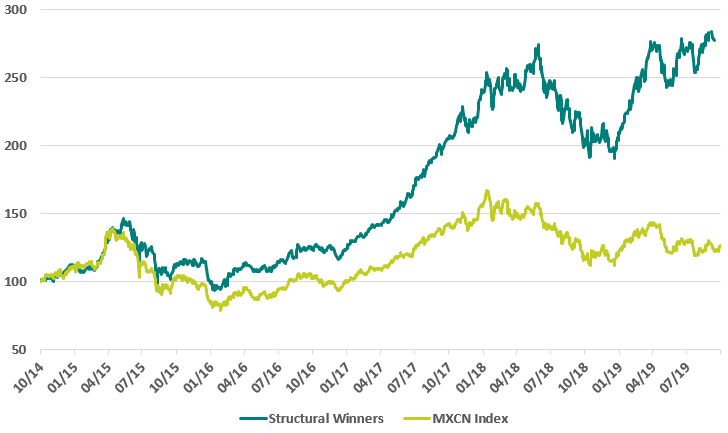

Given these attractive growth and valuation attributes, we believe that Chinese equities in aggregate will outperform other major markets over the medium- and long-term. Crucially however, we also believe that such outperformance can be significantly enhanced by targeting companies within China that are the biggest beneficiaries of the ongoing structural transformation of the economy. This transformation includes the increasing proliferation of e-commerce (online sales now account for over a quarter of China’s total retail sales), ‘premiumisation’ – where consumers trade up to higher value goods and services as they become wealthier, and new business models such as Fintech that are reshaping how Chinese people live their lives, both now and in the future. Unsurprisingly, a basket of these “structural winners” has outperformed the wider MSCI China Index by 128% over the last 5 years.

Performance of “structural winners” basket versus MSCI China index: 3Q2014 to present

Source: Bloomberg, HSBC | “China Structural Winners Basket” Includes: Alibaba, Tencent, Ping An, Moutai, China Merchant Bank, CNOOC, Gree, Hengrui, Taitian, Yili, Anhui Conch, Shenzhou, Longfor, Anta, TAL Edu, Luxshare, CR Beer, Sany Heavy, Sunny Optical, ENN Energy

Many of China’s “structural winners” operate in the consumer segment. This includes not only the consumer staples and discretionary sectors, but also broader consumer facing areas such as life insurance, autos, real estate and ecommerce. Even in a weaker macroeconomic environment, leading companies in these industries are enjoying rising penetration and adoption rates as well as substantial market share gains.

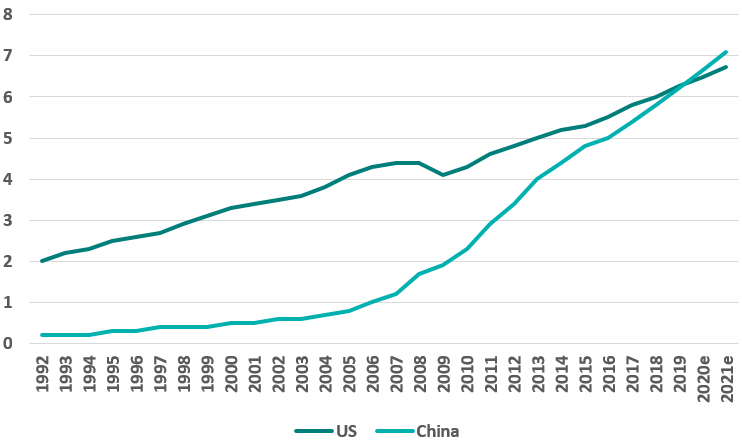

Part of the reason that these companies are able to be so successful is that China’s total addressable market is almost unimaginably vast. In fact, China is now the world’s largest consumer and is continuing to grow.

China versus US annual retail sales (US $)

Source: CICC Research, Wind

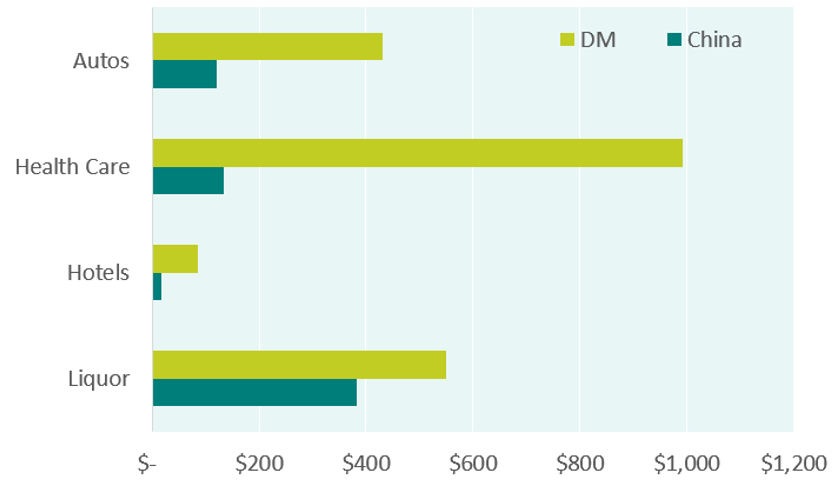

In our view, this fact is yet to be reflected in stock market valuations, meaning China has huge catch-up potential versus Developed Markets.

China versus Developed World (industry market cap, USD bn)

Source: TT International, Bloomberg

Although China is a single country, the reality is that it is a continental-sized economy. One trap that investors often fall into is treating Chinese consumers as a homogenous block. In truth China’s Gini coefficient is one of the highest in the world. This suggests severe inequality, with contrasting spending power across various provinces and regions. Thus, there are big differences within China that investors need to be aware of, and each province can almost be considered a separate market. For this reason, companies with a national presence and scale are likely to be most successful if they are able to develop a product range with multiple brands that offer various price points to suit the affordability of a diverse customer base.

While China’s high Gini coefficient and per capita GDP of just USD8250 point to swathes of poor consumers, sustained urbanisation is expected to create another 150 million city-dwelling citizens over the next five-to-ten years, with incomes rising dramatically as a result. This provides a lucrative opportunity for China’s leading brands to upgrade their product offerings as their customers become more willing to consume higher value, premium goods.

The TT China Focus fund has significant exposure to this structural trend of premiumisation. Of course, as people become wealthier, they tend to demand more than just higher value goods. Increasingly they also expect more sophisticated healthcare, education and financial services. Again the China Focus fund has significant exposure to this so-called ‘Second Wave of Consumption’.

Just as some investors are in danger of homogenising and oversimplifying China, others fall into another trap: chasing consumer fads, which in China can be particularly pervasive and ultimately ephemeral. Today the key cohort of consumers is people born after 1990, and in some cases even post 2000. Their liability streams are quite different to those of their parents, who typically bought a house, were generally more frugal, and engaged in more inconspicuous consumption. Younger Chinese consumers are largely from single-child families, which have allowed their parents to take care of them financially and, in many cases, buy them a house outright. As a result, they have far higher disposable incomes, which may help to explain the prevalence of consumer fads in China. To take one example, the People's Bank of China recently felt it necessary to warn people about the dangers of speculating on sneakers, which can sell for thousands of dollars. As investors, it is important that we understand the unique intricacies of the Chinese consumer landscape. There are a great many faddish companies in China that are currently growing their revenues very quickly, yet generate no profits. They are burning through cash at an alarmingly rapid rate, often subsiding customers at 20-30 cents on the dollar using money that was raised through private equity. We believe this model is unsustainable and that they will need to replenish their capital sooner rather than later.

It is a similar story with many companies that are associated with other aspects of the structural transformation reshaping China’s economy, notably those exposed to hi-tech developments such as 5G, Cloud Computing and Artificial Intelligence. These companies may operate in glamorous areas that show great promise, but the stark reality is that a lot of them do not make any money. Some of these companies will undoubtedly be the winners of tomorrow, but it is extremely difficult to predict, and very costly to get wrong. For every Facebook, there are surely hundreds of Myspaces.

Our process is specifically designed to avoid such faddish, unproven companies that we regard as inherently risky. It aims to find the best investments by integrating top-down and bottom-up analysis. The top-down research helps us to identify the most promising areas of the market and we then focus our bottom-up research efforts there. From a bottom-up perspective, we combine value, quality and growth aspects, with a specific focus on free cash flow. This focus on cash flow is for three reasons. Firstly, fickle capital flows in Emerging Markets such as China can undermine a company’s capacity to finance its growth – we need to be certain of cash generation throughout the cycle. Secondly, structural inefficiencies in Emerging Markets often mean that share prices only reflect the benefit of expansionary capex close to the moment a project launches. Thus, free cash flow inflection points can be strong catalysts. Finally, we find it incredibly useful to frame our discussions with management around the use of excess cash. For example, do they have high ROIC projects, and, if not, would they be willing to return the capital? A focus on cash allocation promotes an alignment of interest with management.

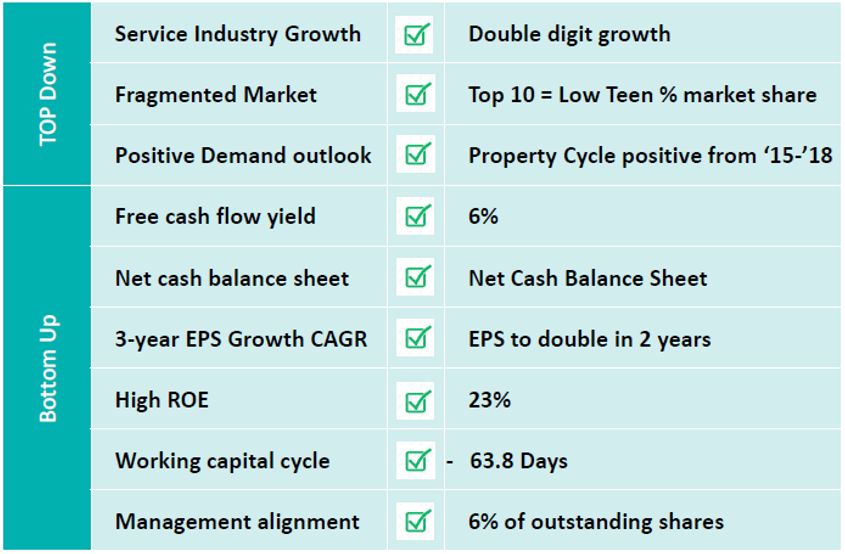

One example of our rigorous process at work is the fund’s holding in A-Living Services, a property management services company. It is a key beneficiary of the ‘Second Wave of Consumption’ top-down trend that is playing out across China as wealthier consumers begin to demand more sophisticated services. We believe it will be a multi-year growth story as it transitions from a simple property management company towards a model that includes offering Value Added Services. These services are already offered by global property services companies, and A-Living’s peers in China have begun to experiment with different business models such as on-premise O2O delivery services, children’s education, housekeeping and consultancy services. Crucially, these services are higher margin than the existing book of business. A-Living Services recently acquired a stake in two property managers that should substantially boost its scale and earnings visibility in the medium term. Gross Floor Area gained from the acquisition will make the company one of China’s largest property management companies and help it penetrate the community Value Added Services market. The shares have performed well for the fund, adding 167 basis points of alpha in the 5 months that we have owned them. Despite the strong performance, we continue to like the company, especially given its structural growth opportunity, strong net cash balance sheet, high free cash flow yield, and additional growth potential stemming from the recent acquisition. As can be seen below, it ticks many boxes from both a top-down and bottom-up perspective.

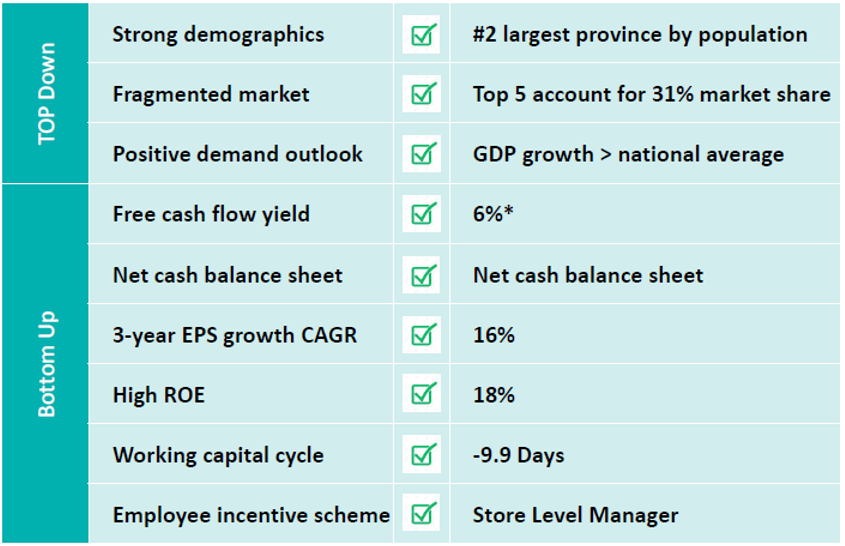

Another example of the culmination of our process is JiaJiaYue, a leading regional supermarket chain in Shandong province. In early 2018, our top-down macro analysis suggested an imminent pick-up in inflation, which led us to look for beneficiaries of this trend. Our bottom-up analysis identified JiaJiaYue, given its robust balance sheet, attractive valuation and strong free cash flow yield. We continue to believe it will be a major beneficiary of food inflation and premiumisation in China. Indeed, many of the smaller food retailers have now been acquired, meaning the remaining players should enjoy substantial pricing power. JiaJiaYue has a strong offering in terms of fresh produce and a solid supply chain backbone. Its 15% gross profit margin on fresh products is superior to any of its listed peers. We expect revenue growth to accelerate, largely due to organic store expansion and M&A consolidation. We have owned the stock since February 2018 and it has generated 146 basis points of alpha for the fund since then. However, we continue to like the company as it still demonstrates many of the key attributes we look for in a business.

*when we bought a position

By following the disciplined and differentiated process outlined above, our strong and experienced China team have outperformed their benchmark by 3.8% per year since the fund’s inception in October 2017. The China team are also key members of our wider Emerging Markets team, which have outperformed their benchmark by 3.4% per annum using the same process since the inception of the Global Emerging Markets fund in April 2011. Crucially, we believe this process is entirely repeatable as it does not rely on any particular style bias and has been proven to work in numerous market environments. We therefore hope to continue achieving our objective of outperforming by at least 3% per annum, adding substantial value for our investors.