Mike Jennings, Investment Strategist, discusses TT's outlook for the year ahead.

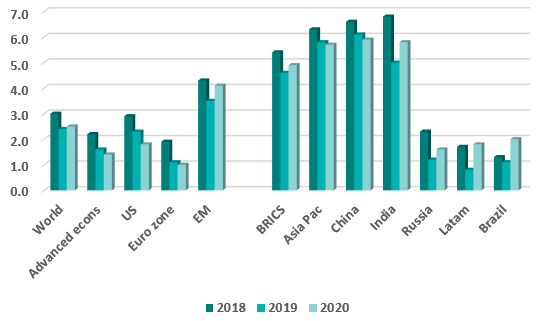

Heading into 2019, investors were worried that rising interest rates, a slowing global economy and the threat of an all-out trade war would leave late-cycle equity markets vulnerable to a correction. Some of these fears were realised, with global growth slowing from 3.0% in 2018 to 2.4% in 2019, as can be seen below.

Real GDP Growth (%)

Source: World Bank ‘Global Economic Prospects’ Jan 2020

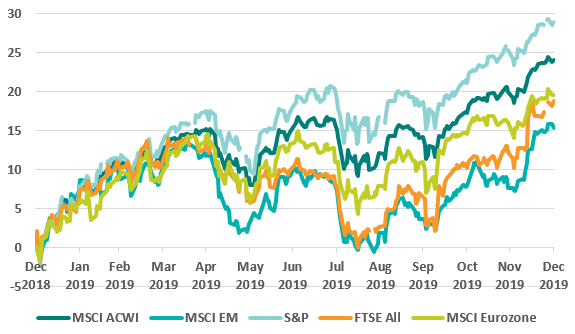

Crucially however, deteriorating economics failed to constrain positive equity returns. The key was a sharp policy u-turn by the Fed, which led to 3 Fed funds rate cuts during the year and prompted other central banks to become more dovish. This boosted liquidity, kept the cost of capital low, and enabled strong equity returns, largely through a valuation re-rating as opposed to earnings growth. Yet again, the US led the world in terms of equity market performance, with the S&P producing a 29% return.

2019 Equity Market Returns (USD) (%)

Source: Bloomberg

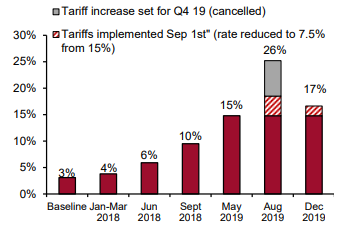

Whilst many of the macro concerns from early 2019 remain justified as we move into 2020, the risk of a disorderly deterioration would seem to have abated considerably. The Fed has eased, and the US consumer has held up remarkably well. Whilst we would not expect more Fed easing in 2020, there would seem to be a willingness to do so if conditions necessitate. The US has also rowed back from December’s planned tariff increases on Chinese goods and “Phase 1” of the trade deal has been signed.

Expected US average tariff rate on Chinese imports

Source: Credit Suisse

The fact that trade negotiations have dragged on throughout 2019 has given Beijing time to offset much of the impact on the Chinese economy, with both fiscal and monetary easing now providing a fillip to growth. Whilst we would certainly expect Sino-US trade relations to remain challenging going forward, the point of greatest risk appears to be behind us.

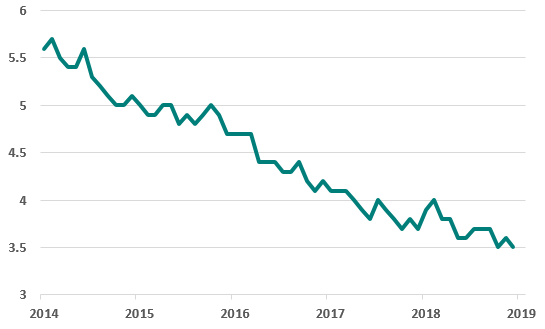

Although we did not expect anything as spectacular as a 24% dollar return from global equities in 2019, unlike many investors we did not take a bearish stance, despite multiple risks including the inversion of the US yield curve. The primary reason for us to remain sanguine-yet-vigilant was US unemployment, which has fallen to a near 50-year low.

US Unemployment Rate (U3) (%)

Source: Bloomberg

In our view, an end-of-cycle slowdown is unlikely without a marked pick up in unemployment. We will continue to monitor the US labour market closely in 2020, looking for signs of deterioration. Without such a warning signal, we would expect the US economy to generate modest growth, supported by healthy consumption and accommodative Fed policy.

Another major risk in 2019 that seems to have substantially abated – at least in the short term – is Brexit. Policy stalemate and crippling uncertainty had caused capital expenditure to seize up in the UK and elsewhere in the EU, albeit to a lesser extent. However, the landslide victory for the incumbent Conservative party in December gives them a strong mandate to move forward on their Brexit policy with very little opposition to stand in their way. It is now clear that the UK will leave the EU on January 31st. As a result, some of the stalled capex should now be spent. Fiscal easing, especially on infrastructure, will shortly be unveiled to add a further impetus to an otherwise sluggish economy. After several years of persistent net capital outflows, the UK equity market has de-rated from valuations comparable with the US in 2016 to those akin to Emerging Markets today.

P/E (based on 2020 estimated earnings)

Source: Bloomberg

We would expect strong support over the coming months, a modestly firmer pound, and stock leadership favouring domestics over exporters. To a lesser extent, the removal of Brexit uncertainty should benefit European economies and markets. That said, initial relief may give way to renewed concerns over a near impossible 31st December deadline to achieve a trade agreement with the EU. Investors should therefore tread carefully and avoid becoming complacent.

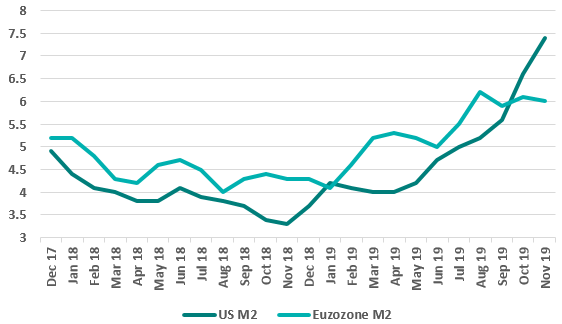

This is also true in a global sense, particularly as the removal of some of the risks from 2019 has already led to a rerating, meaning that global equity market valuations look challenging relative to history using conventional measures such as P/E and P/B. Crucially however, they are also attractively valued relative to historically depressed bond yields, and according to free cash flow metrics. Moreover, money supply growth is accelerating, as can be seen from the chart below.

US and Eurozone Money Supply Growth (M2) (%)

Source: Bloomberg

While liquidity remains plentiful, yields stay low, and global growth shows signs of stabilisation, we see little reason why equity markets cannot continue to make further modest gains in 2020.

This backdrop should be particularly advantageous for Emerging Market equities, but not necessarily for the reasons that many investors might expect. Indeed, EM equities are typically perceived to be the ‘beta trade’ – moving in the same direction as Developed Markets, but usually by a greater magnitude. We would argue that such a view is overly simplistic. Although this perception is still valid for smaller, less liquid manufacturing hubs that are dependent on western consumption, it no longer applies to most of the EM universe. For example, whilst EM equities produced strong absolute returns in 2019, they lagged the gains made in Developed Markets, particularly the US. This lag can be attributed to a number of headwinds in 2019, most notably concerns over trade wars, geopolitics (such as a far right government in Mexico and a collapsing power grid in South Africa), and a slightly stronger US dollar. Thankfully, many of these headwinds seem to have moderated.

Perhaps most importantly, there is a strong correlation between the relative economic growth rates of EM versus DM and their relative equity market performance. According to World Bank data, the growth rate in advanced economies fell by 0.6% in 2019, from 2.2% to 1.6%. Meanwhile in Emerging economies it fell by 0.8%, from 4.3% to 3.5%, contributing to EM underperformance. The World Bank expects developed world growth to fall a further 0.2% to 1.4% in 2020. However, growth in the emerging world is expected to accelerate by 0.6% to 4.1%.

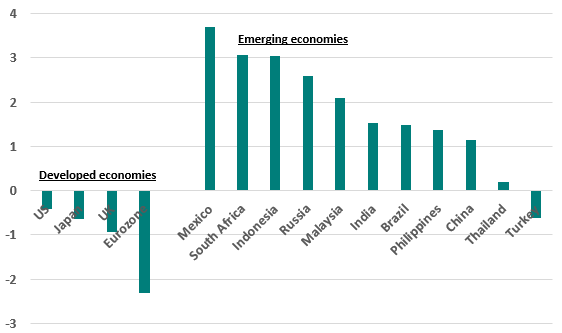

Thus in a world where growth is scarce, Emerging Markets stand out as the exception. Asia will remain the world’s primary engine of growth, with expected real GDP growth of 5.7% in 2020, partly due to a re-acceleration in India. This should be supplemented by recoveries in economies such as Brazil and Russia. We have already mentioned the importance of liquidity support and, in this regard, EM also looks attractive. As can be seen below, emerging economies offer some of the largest real yields globally, suggesting that there is greater scope for monetary easing to boost growth further.

Real Yields (2 Year - CPI) (%)

Source: Bloomberg. Note China CPI is ex-food

Of course, Emerging Markets will continue to vary substantially in terms of growth, politics and economic policy. This means selectivity is critical at the country, sector and stock levels. With a rigorous process linking both top-down and bottom-up drivers of returns, readers will be unsurprised to hear that some of our favourite markets have high real yields and scope to ease monetary policy in 2020. India, Brazil, Russia and China are four such markets that we regard as attractive from a top-down perspective and where we are currently finding many exciting bottom-up investment ideas.

With the threat of ever-increasing trade tariffs hanging over China like the Sword of Damocles for more than a year, business confidence has taken a hit and investment has stalled. The natural reaction for businesses anticipating such uncertainty is to reduce inventories, which only serves to exacerbate the slowdown. Of course, this effect also works in reverse, and many companies have indicated to us that an inventory rebuild is now underway in response to the partial thaw in trade tensions. The Chinese authorities were pro-active in terms of monetary and fiscal stimulus in 2019, and we should expect to see far less of this in 2020. However, the RRR cut in early January is undoubtedly helpful and demonstrates Beijing’s ongoing willingness to stimulate. The Chinese Manufacturing PMI appears to have convincingly picked up from its trough levels, and Total Social Financing (a broad measure of liquidity) has rebounded sharply. Meanwhile, December’s export data showed a 9% year-on-year gain, corroborating the view that a cyclical recovery is underway. Given this macro backdrop, we particularly favour Industrials, Property and other domestic consumption plays.

Two other large Emerging Markets that we favour in 2020 are India and Brazil. We have been overweight India in our Asian and Emerging Markets portfolios since Prime Minister Modi came to power in 2014. Having convincingly won the General Election again last year, we are positive that his reform programme will reignite economic growth. Many of his reforms have stunted growth in the short term, but are positive for sectors such as Property and Banking in the medium/long term. For example, the Real Estate Regulation Act constrained developer cash flows in a bid to weed out speculative development. However, this constraint on growth is now largely behind us, leaving the higher quality developers to enjoy a strong market recovery. Elsewhere, the Banking sector has been notoriously poor at passing on rate cuts to businesses and the consumer. Again however, it seems that this issue is being resolved, which should drive an acceleration in economic activity and capital investment. Cuts in interest rates and corporation tax last year should also provide a strong rebound in economic growth, corporate earnings and, in turn, stock market performance. The push back on India is that it always appears to be expensive relative to other Emerging Markets. We would generally agree with this argument, but note that this is due to a few large companies (often foreign affiliates) that are grossly overpriced. Indeed, we continue to find many interesting companies – typically domestic mid-caps – that have high-quality management teams and strong earnings growth, yet trade at extremely attractive valuations, largely because they are under-researched.

Elsewhere, Brazil is a market that we have been overweight since it became clear that right wing candidate Jair Bolsonaro was on course to become President. Binary outcomes between candidates on the far left and the far right are typical in Emerging Markets, where the result of such political battles can set the tone for the economy and markets for many years thereafter. In Brazil there are several economic headwinds, but the cost of equity has fallen sharply, and the thorny issue of social security reform has been tackled with greater success than many commentators would have anticipated. We expect further modest monetary easing to provide an economic tailwind in 2020, and anticipate a recovery in consumer confidence and domestic demand. Our stock focus is therefore targeted specifically on these areas.

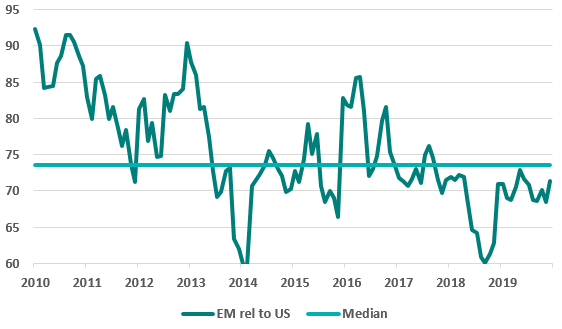

Looking around the world today, investors will be acutely aware that this market cycle has been exceptionally long, and that valuations on traditional metrics are at the high end. While hard to dispute, the same could have been said at this time last year, before equity markets produced double-digit gains. Overly defensive positioning would have been very costly in 2019. Moreover, there is still relative value available. For example, if we consider EM relative to DM, then despite superior and accelerating economic growth, valuations are still compelling. On historic P/E metrics, EM trades 29% ‘cheap’ versus the US S&P and is modestly below its 10-year median discount in this regard.

EM Valuation Relative to S&P

Source: Bloomberg

Even with the attractive relative valuations on offer, the recent flare-up between the US and Iran is a reminder that investment is never straightforward and risks lurk around every corner. Renewed conflict in the Middle East and an oil price heading towards $100 would certainly put the brakes on equity market progress, and many other surprises could cause us to alter our base case in the months ahead. However, in the absence of such surprises, we remain vigilant but constructive on global equities, particularly those in Asia and Emerging Markets more generally. Absolute returns are unlikely to compare in magnitude to those in 2019, but should be positive, with plenty of opportunities for alpha generation. We also expect a changing leaderboard, with Emerging Markets and UK equities showing strength relative to a lagging US.