We believe that Trump’s election victory is an enormous opportunity as we cross the Rubicon into a more volatile, polarised world. This investment environment will likely be characterised by increasing uncertainty, event-risk, and a divergence in performance between relative winners and losers. In short, it should suit truly active, contrarian and agile investors such as TT. In this piece, we discuss some of the scenarios that markets may be overlooking, and therefore where opportunities could lie, before outlining some potential EM winners and losers from a Trump presidency.

Donald Trump’s decisive victory has led to much doom-mongering among economists and EM investors alike. The consensus seems to have settled around a simple narrative that tariff threats will lead to higher inflation, less monetary easing and a stronger dollar. Amid a salvo of America First rhetoric, EM equities have underperformed their US counterparts since the election, and now languish at their biggest price-to-earnings discount in over 20 years. Outflows from EM bond funds also accelerated, taking this year’s total net outflows to more than $20bn. However, as we discuss in the following piece, there are good reasons to believe that the consensus is overlooking a number of eminently plausible scenarios, which could leave many investors wrong-footed. In a more fundamental sense, the election result is an enormous opportunity as we cross the Rubicon into a more volatile, polarised world. This investment environment will likely be characterised by increasing uncertainty, event-risk, and a divergence in performance between relative winners and losers. In short, it should suit truly active, contrarian and agile investors such as TT. We will now discuss some of the scenarios that markets may be overlooking, and therefore where opportunities could lie, before outlining some potential winners and losers from a Trump presidency.

Tariffs

Trump has threatened to impose tariffs of 25% on all imports from Canada and Mexico, and an extra 10% on Chinese goods. He has also hinted that tariffs on various countries and other protectionist measures will follow. Markets appear to have taken him at face value and concluded that this will have a material impact on inflation.

However, this overlooks several important considerations. Firstly, currencies are highly efficient shock-absorbers that can often mitigate much of the impact of a tariff. If, as the consensus believes, the Dollar continues to strengthen, then imports will become proportionally cheaper. Evidence from Trump’s first presidency shows that the effect of tariffs on Chinese imports into the US was substantially offset this way.

Secondly, companies will look to adapt, for example by rerouting trade through other countries, cushioning the blow. A dirty secret of tariffs is that ‘country of origin’ is very difficult to demonstrate. A Chinese manufacturer whose goods travel through multiple countries before landing on US soil will be hard, if not impossible, to police.

Finally, Trump prides himself on being a dealmaker. He is well-known for using incendiary rhetoric to put pressure on adversaries to make a deal – the so-called “escalate to de-escalate” strategy. Trump will surely be aware that inflation is one of the key reasons for incumbents being voted out across the developed world. He must also appreciate that US industrial policy is heavily reliant on AI chips from Taiwan. Moreover, whilst Trump has been at pains to stress the damage that tariffs would inflict on rival economies, they could end up being friendly fire as the IMF predicts that tariffs would actually have a bigger negative impact on growth in the US than China. The argument that tariffs are a negotiating tool that could be moderated is given some credence by Trump’s nomination for Treasury secretary, Scott Bessent, who recently described sweeping tariffs as “maximalist” positions. For all these reasons, Trump’s tariff bark may be worse than his bite.

Inflation

The consensus also expects Trump to be inflationary, not only because of potential tariffs, but also because of threats to deport millions of migrants, which could lead to upward pressure on wages. Again, this misses some important points.

Trump’s victory was due in part to a backlash against inflation, for which the electorate blamed the incumbent. Whereas when Trump first came to power it was deflation that kept policymakers awake at night, now it is higher inflation that is leading to politicians being unceremoniously shown the exit. This year, in the 50 most populous democracies, incumbents have won 14% of the elections in developed countries, where inflationary surprises were particularly acute, compared with 73% in developing countries. This trend is mirrored in approval ratings; leaders are deeply unpopular on average in the developed world but are still popular in developing nations. Against this backdrop, policies that could stoke inflation may end up being moderated.

Additionally, several aspects of Trump’s potential policy agenda may prove to be disinflationary, be it deregulation and the government efficiency drive spearheaded by Elon Musk, or Trump’s plans to “drill, baby, drill.” Indeed, we are likely to see a major positive inflection point in US hydrocarbon production at a time when a lot of additional production is coming online from the likes of Brazil, Guyana, and Argentina in due course.

US Dollar

Taken to its natural conclusion, the consensus argument runs that higher inflation will slow the pace of rate cuts in the US, a train of thought that has contributed to a stronger Dollar. We have often commented about the strong inverse relationship between the Dollar and EM equity relative performance, so this would likely be a headwind for EM assets. But here once again investors may be overlooking some important factors.

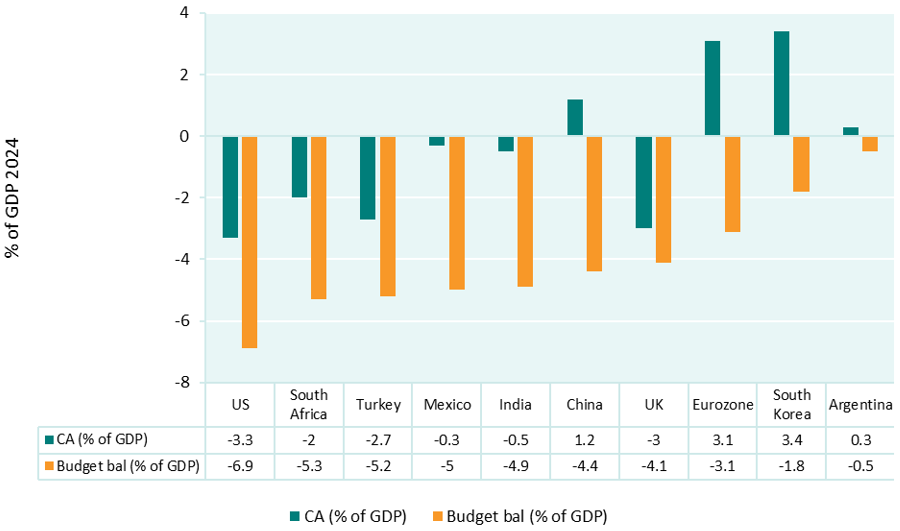

Firstly, the US budget deficit is already forecast to be 6.9% of GDP this year, and it will likely deteriorate further should Trump implement some of the tax cuts he promised during his campaign. It has been estimated that the revenue loss for the federal government would be $9 trillion if all proposed changes were adopted. As can be seen below, the US already has a twin deficit that makes those in most emerging economies look tame.

Current account and budget balance

Source: Economist

Whilst it is difficult to argue against Dollar strength in the short term, over time these gaping deficits will almost certainly raise the risk premium for owning Dollar denominated assets, and pressurise the currency itself.

The case for Dollar strength based on the notion that the Fed will slow its pace of rate cuts due to potential inflationary policies also seems to fundamentally misunderstand how the central bank operates. It does not have a mandate to pre-emptively adjust monetary policy ahead of possible changes in economic policy. As Thomas Barkin, a voting member on the rate-setting committee, commented recently: “We shouldn’t try to solve it before it happens.” When making decisions on interest rates, the Fed will simply react to economic data such as inflation after it is released, and as we discussed above, there are certainly reasons to believe that Trump will not be as inflationary as the market fears.

Potential winners and losers under Trump

We have engaged in much conjecture about various scenarios that may or may not come to pass. However, what seems certain is that we are entering a more volatile, polarised world that will see an increasing divergence in performance between relative winners and losers. So, which areas of the market look particularly well or poorly placed under a Trump presidency?

Argentina would appear to be a key beneficiary. This is a country that has been disastrously mismanaged over decades and therefore abandoned by most emerging market investors – both fixed income and equity. However, President Milei has made sweeping changes to the bureaucracy and red tape that has held the country back and, in less than a year, has converted a 3% primary fiscal deficit into a 2% surplus. With the trade deficit having also turned to a surplus, Argentina would appear to be relatively well insulated from an external shock. Many aspects appear to be moving towards the bull case, with tax revenues, economic activity levels and inflation all tracking well. The government has set a 5% growth target for next year, which we believe is conservative. Indeed, the energy sector is already booming, and the mining industry is heating up, spurred by Milei’s tax incentives that encourage long-term investment, with $7-8bn of projects already sanctioned under the new tax regime. Argentina’s main fragility is that central bank reserves are negative – a key impediment to floating the currency. To solve this issue, either reserves could be built up over time, or there could be a capital injection from the likes of the IMF. This is where the close relationship between Presidents Trump and Milei may be helpful. The IMF will be closely monitoring Argentina’s progress in terms of fiscal rectitude and tackling inflation. With Trump potentially throwing his weight behind the discussions, the likelihood of an IMF loan to expedite a partial currency floatation would appear to have increased, whilst a free trade agreement between the US and Argentina could materialise further down the line. Argentina is the largest overweight country in TT’s EM equity strategies, and is also the largest risk exposure within our EM Long/Short strategy.

Other peripheral markets with positive idiosyncratic dynamics are also likely to perform relatively well. For example, after a period of mismanagement, South Africa has recently seen a change in government that is bringing incremental improvements which should unlock growth. There have been some market friendly measures, and the budget is moving to a primary surplus. A new points-based immigration policy to develop key industries by attracting leading global talent will likely benefit the wider population in a country where unemployment remains over 30%.

Another example is Turkey, which in some ways resembles Argentina in the sense that inflation has spiked due to gross mismanagement, but is now being reined in by a return to economic orthodoxy. With monetary policy in extremely restrictive territory, and fiscal policy likely to become slightly contractionary next year, inflation should continue on its downward trajectory. This should eventually enable monetary loosening, providing an exciting opportunity for this depressed market to re-rate, particularly the banks that are very sensitive to rate cuts.

India is another potential beneficiary as it is geopolitically ‘neutral’, with a vast domestic economy that is relatively isolated from tariff rhetoric. It should also benefit from lower oil prices in a scenario where an increasing supply of hydrocarbons, principally from the US, meets weakening global demand.

Taiwan is an interesting case. There is certainly a risk that it is caught in the crossfire as Sino-US tensions ramp up. However, it is difficult to see how US industrial policy can succeed without AI chips from Taiwan. As the domestic US technology industry is encouraged to develop, it is plausible that Trump trades military support and relief from tariffs in exchange for Taiwanese chips being manufactured on US soil.

On the other side of the coin, twin deficit countries are likely to be particularly vulnerable to an external shock, be it from tariff rhetoric or spikes in risk premia amid heightened volatility. Southeast Asian economies such as Thailand and Indonesia would fall into this category.

But it is Mexico and China that have the most to lose under a Trump presidency. Mexico’s socialist government was already implementing market-unfriendly reforms before Trump’s victory, and the country is now firmly in Trump’s tariff crosshairs due to its failure to control the flow of illegal drugs and immigrants across the border. For an economy that is heavily reliant on the US, this is a major risk. We will not go into great detail about the risks to China’s economy as there has already been a lot of ink spilled on that subject. Needless to say, China has been a key underweight for us, given the range of problems facing the economy as it struggles to transition from export- and investment-led growth towards domestic consumption. These problems are likely to be exacerbated by an adversarial US president. However, we believe that China is waiting to assess the measures that Trump implements once in power, and will likely use stimulus measures to mitigate the impact. This could result in sharp relief rallies, and we stand ready to rapidly adjust positioning should this be required.

From an EM Debt perspective, we are still bullish on duration, and believe that US Treasury yields will remain volatile but continue to tighten. We see limited scope for further tightening of EM Investment Grade spreads. However, we think that EM Debt, including Investment Grade, will generally be seen as a compelling carry opportunity for a number of reasons. Indeed, EM fundamentals continue to improve, the EM growth differential over DM remains high, whilst EM and DM are at different points in their respective credit cycles, meaning that default rates will likely fall in EM as they rise in DM. More specifically, we see potential for outsized returns in special situations in distressed Asia credits, selective African frontier markets (especially Ghana and Senegal), Sri Lanka, and other special situations such as Venezuela and Lebanon. Conversely, we believe that parts of the EM High Yield market are now relatively frothy and crowded, and we are therefore being increasingly selective in the BB/B+ category. Given the aforementioned potential for the US Dollar to weaken in the medium term, we have a positive bias on EM FX and will continue to play this tactically, given the expected upcoming volatility. We are particularly positive on various currencies in Asia – especially South East Asia – and LatAm. Finally, we expect increased dispersion in local rates. We believe that high volatility in Brazilian rates should enable us to generate alpha, and are confident that inflation will remain under control in the rest of LatAm. We expect South East Asian central banks to be able to cut rates further, which should prove positive. However, we remain sceptical that long-term yields can continue to fall significantly in China, and we expect to see increasing divergence in CEEMEA after a significant rally in local markets.

A perfect fit

A common thread running through our comments above is that we expect the world to become increasingly volatile and polarised. In this environment, pragmatism and agility will be key to success. Passive approaches to managing EM assets are unlikely to work well, whilst active managers with a buy-and-hold mentality may also struggle. At TT we have always been comfortable exploiting the inherent volatility in emerging markets and venturing off the beaten track in our pursuit of alpha. Our disciplined approach to capacity management preserves the integrity of our investment process, affording us the flexibility to rapidly capitalise on opportunities as they present themselves.

For example, both our long-only and long-short equity products have generated substantial alpha from a range of opportunities this year, most notably being early investors in the Argentinian recovery. At the time of writing (17th December), our long-only Global Emerging Markets strategy composite has outperformed its benchmark by +11.6% net so far this year, whilst our long-short product has generated net returns of +41.6% over the same time period. Our recently launched EM debt strategies also employ an active, nimble and often contrarian process to generate alpha. Focusing on under-researched, mispriced markets, they aim to identify behavioural biases or market ‘blind spots’, where certain scenarios are overlooked because of entrenched beliefs. Indeed, emerging market assets often trade as though an outcome is almost certain, with investors crowding together in consensus positions that can be exploited – now more than ever. Trump is not a conventional president, and we believe our unconventional approach offers the perfect fit for this new investment paradigm.

Important information: This information is issued by TT International Asset Management Ltd (“TT”), authorised and regulated in the United Kingdom by the Financial Conduct Authority. This information is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. The circulation of this information is restricted to professional investors as defined in the legislation of the jurisdiction where this information is received. No representation is made as to the accuracy or completeness of any information contained herein, and the recipient accepts all risk in relying on this information for any purpose whatsoever. Without prejudice to the foregoing, any views expressed herein are the opinions of TT as of the date on which this information has been prepared and are subject to change at any time without notice. TT does not undertake to update this information. Any forward-looking statements herein are inherently subject to material business, economic and competitive risks and uncertainties, many of which are beyond TT’s control and are subject to change. The information herein does not constitute an offer of shares or units in any fund, and it is not an offer to, or solicitation of, any potential clients or investors for the provision by TT of investment management, advisory or any other comparable or related services. No statement in this information is or should be construed as investment, legal, or tax advice, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations. This information expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient. Any person considering any investment should consult the offering documentation if and when is made available. Investments carries with it a high degree of risk. Past performance is not necessarily indicative of future results and investors may not retrieve their original investment.

All performance data stated is as at December 17, 2024. There is no assurance the TT Emerging Markets Strategies will achieve their goals. Past performance is not indicative of future results and you may not recover your original investment. Performance statistics are total returns for investments priced in USD. They are provided by TT and not necessarily based on audited financial statements. This information may not be representative of the strategies’ current or future investments. TT will make available further information concerning such data, upon request.