With consistent outperformance in the three years since Duncan Robertson took on primary responsibility for TT’s Asia Pacific ex-Japan strategy, we assess the investment opportunities within the asset class and explain how TT’s process seeks to exploit these opportunities.

We believe that Asian equities represent an excellent investment opportunity for several key reasons. Firstly, Asian GDP growth is superior not only to Developed Markets, but also to other Emerging Markets. Growth opportunities are especially compelling in countries such as Indonesia, India, Pakistan, Bangladesh, Vietnam and the Philippines, all of which have particularly dynamic economies with young populations. In addition to favourable demographics, Asia is the key global beneficiary of lower oil prices as its ratio of net oil imports to GDP is the highest in the world. Finally, Asian equities as a whole remain 17% ‘cheap’ relative to their developed world counterparts on a price-earnings metric, and 27% ‘cheap’ on a price-book basis. With consistent outperformance in the three years since Duncan Robertson took on primary responsibility for TT’s Asia Pacific ex-Japan strategy, we assess the investment opportunities within the asset class and explain how TT’s process seeks to exploit these opportunities.

There can be no doubt that Asian equity investors have had a tumultuous time over the last three years. In China there was the short but powerful bull market of late 2014 into early 2015. This was swiftly followed by renewed fears about Chinese growth and deflation. Asia’s other behemoth, India, has been equally volatile. The market surged in 2014 following the election of pro-business prime minister Narendra Modi, but sentiment reversed and eventually morphed into extreme bearishness following the announcement of demonetisation in late 2016. Thus, while Asian equity investors have made decent gains of over 12% in US dollar terms, index volatility has been high. Indeed, from the peak in April 2015 to the trough in January 2016, an investor in the index would have been left nursing paper losses of 31.7%.

So what caused such a sharp sell-off in Asian equities, followed by a similarly strong rebound? And crucially, what does this mean for the asset class going forward?

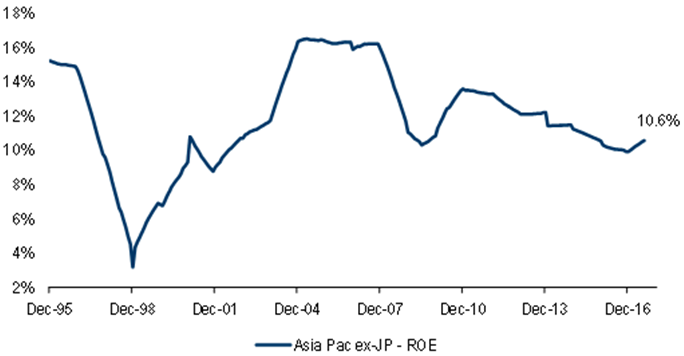

In early 2015 Asian equities were facing a perfect storm; a confluence of factors that conspired to cause market turmoil. Firstly, while world trade growth has been gradually decelerating since the turn of the century, it saw a particularly steep slump in early 2015. As a manufacturing powerhouse with many small, relatively open economies, this slowdown hit Asia particularly hard. Secondly, Asian markets tend to struggle during periods of dollar strength. Thus, the rapid ascent of the dollar from mid-2014 to early 2015 only served to accentuate the sell-off in Asian equities. At the same time, ROEs in Asia were falling and earnings revisions were negative.

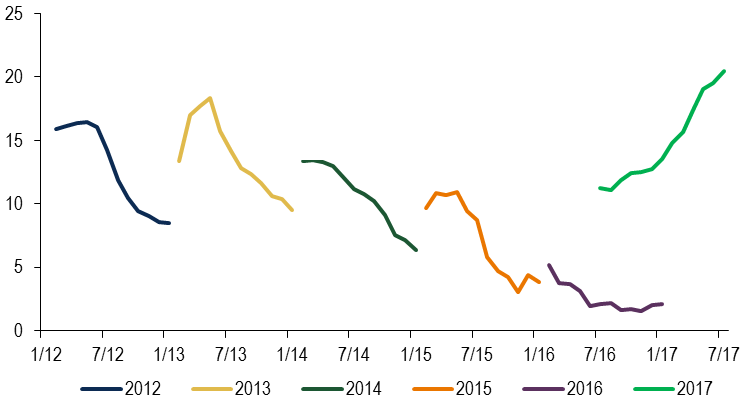

However, many of these headwinds began to subside as 2016 moved into 2017. Global growth began to pick up, with a synchronised acceleration visible in the US, Europe, China, and many Emerging Markets such as India. The latter even succeeded in taking the mantle of fastest-growing large economy in 2016. This improvement in global growth has already provided a boost to Asian exports and is expected to drive a recovery in world trade in 2017 and 2018. Moreover, dollar strength has reversed, largely due to disappointment about President Trump’s policy execution. This not only takes the pressure off Asian currencies, but also lowers the cost of servicing dollar-denominated debt for Asian corporate and sovereign debtors. Meanwhile, as can be seen from the charts below, ROEs and earnings revisions in Asia have both begun to improve. In fact, we are now in the midst of the first earnings upgrade cycle in 5 years.

Asia Pacific ex-Japan ROE

Source: Credit Suisse

MSCI Asia ex-Japan earnings growth estimates (%)

Source: BofA Merrill Lynch

With all this in mind, it is perhaps unsurprising that Asian equities rebounded strongly from their trough in January 2016. In fact, since the turn of this year, they have outperformed their Developed Market counterparts by 10% in US dollar terms. We believe that relative outperformance can continue for a number of reasons:

1. Structural macroeconomic strengths

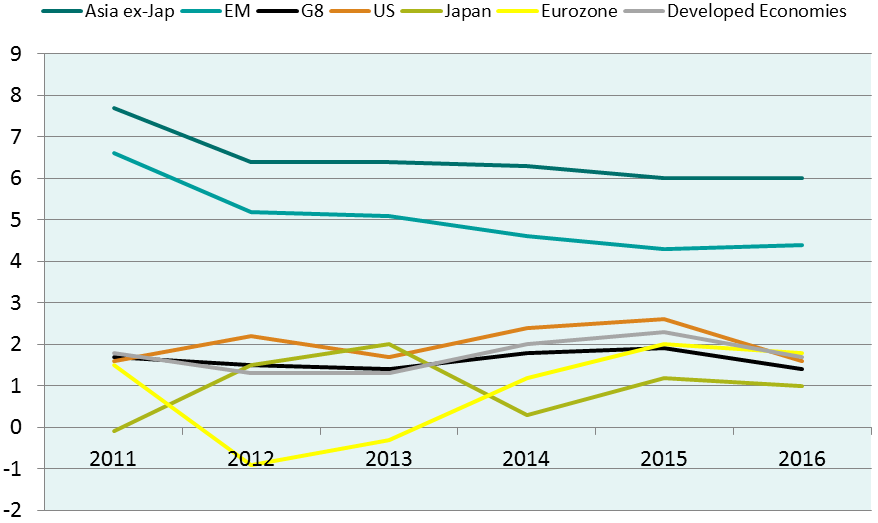

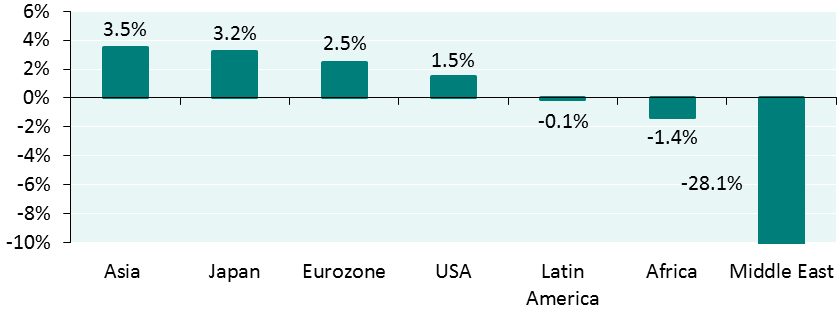

Perhaps most important for those with a long-term investment horizon, Asia boasts some key structural macroeconomic strengths. As can be seen on the chart below, Asian GDP growth is superior not only to Developed Markets, but also to other Emerging Markets.

GDP growth

Source: UN and US Census Bureau

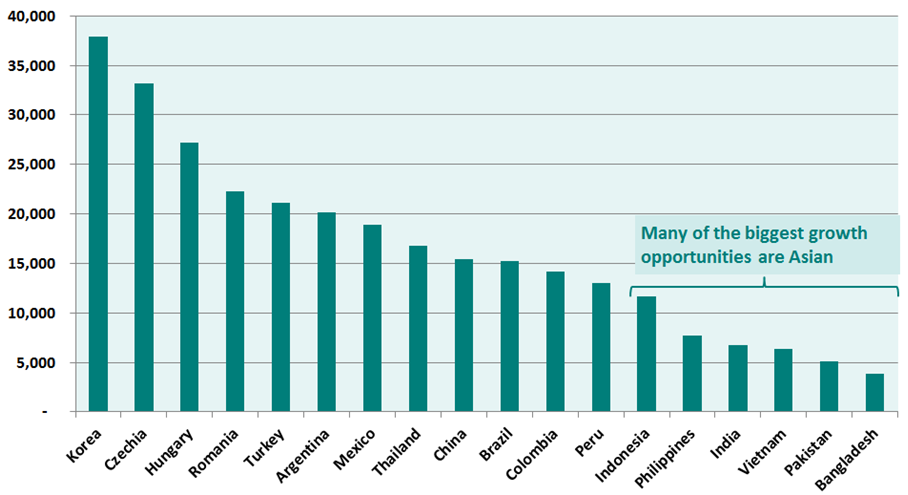

These superior growth dynamics look set to continue, partly as Asia saves significantly more than other regions, allowing it to expand through higher investment. Moreover, the region is still growing from a low base, meaning it has significant catch-up potential and that many of the world’s most exciting growth opportunities are still in Asia.

GDP per capita (2016 est) $

Source: CIA World Factbook

Even China – a true economic powerhouse – still has a lower GDP per capita than Argentina, which until recently was considered by most investors to be an economic basket case.

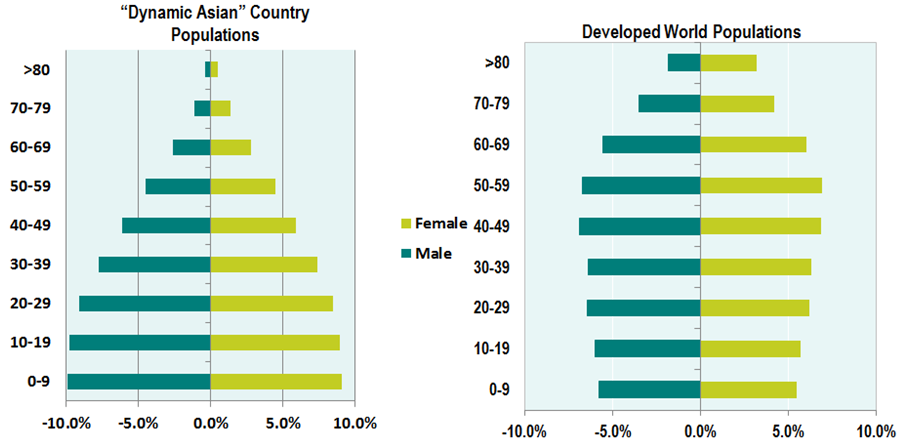

2. Favourable demographics

Growth opportunities are even more compelling in countries such as Indonesia, India, Pakistan, Bangladesh, Vietnam and the Philippines, all of which have particularly dynamic economies with young populations.

“Dynamic Asia” includes Indonesia, India, Pakistan, Vietnam and the Philippines.

Source: Citigroup

3. Beneficiary of lower oil prices

In addition to favourable demographics, Asia is the key global beneficiary of lower oil prices as its ratio of net oil imports to GDP is the highest in the world.

Net oil imports to GDP

Source: UBS

Though the price of oil has risen from its trough in early 2016, we believe it will remain relatively cheap as US producers can easily bring on capacity at $50 or even slightly below. Meanwhile, there is growing pressure on the Gulf States, given their high levels of social spending. This could weaken their resolve to maintain production cuts.

4. Conventional monetary policy

It is also fair to say that Asian monetary policy is reassuringly conventional compared to the developed world, meaning the region’s central banks have more scope to cut rates and stimulate economic activity if need be.

5. Attractive valuations

Finally, Asian equities as a whole remain 17% ‘cheap’ relative to their developed world counterparts on a price-earnings metric, and 27% ‘cheap’ on a price-book basis. Global investors appear to have begun to re-invest into Asia, but after 5 years of net dis-investment, substantially greater flows seem likely. This is good news and should lead to further relative outperformance of the asset class. Of course, in this cheap-money era, few assets are cheap in absolute terms. Asian equities are no exception, trading at around fair value relative to their historical P/E since the turn of the century.

In our view then, Asia represents an excellent investment opportunity, particularly in relation to other regions around the world, but with absolute valuations becoming less attractive in aggregate, the question is what investment strategy will best take advantage of this opportunity?

The case for TT Asia ex-Japan equities

We believe our strategy can offer sustainably superior returns by combining top-down idea generation with a bottom-up focus on investing in higher quality, higher growth companies trading on attractive valuations.

Our process starts with top-down research, which involves the analysis of countries and sectors based on six common variables: liquidity and monetary policy; politics and reform; earnings revisions; relative valuation; currency outlook; and price momentum. This allows us to:

- Systematically identify macroeconomic and reform opportunities arising

at a country level

- Identify the most attractive sectors and themes within countries where

the economic and political conditions favour superior growth of corporate profits

- Avoid vulnerable sectors within higher macro risk countries at certain

points in the economic cycle

We then allocate our bottom-up research resources to focus on the most attractive areas of our universe, based on the top-down themes we have identified. At this stage of the process we are specifically looking for stocks that exhibit an attractive combination of quality, growth and value. To us, “quality” is about investing in leading companies with defendable business models, honest and competent management teams, and strong balance sheets that are capable of delivering high returns on invested capital. With regard to “growth”, we focus on growth of both profits and cash flows. The important point here is that we favour structural growth stories that have the potential to deliver above-market growth for a significant period. Similarly, our focus on “value” is largely based on earnings and cash flow metrics. We are less focused on price-to-book multiples as we believe the value of an asset should ultimately be determined by the cash flows it generates. Perhaps unsurprisingly, the high-quality, high-growth companies that we are looking for are not typically available at low price-to-book multiples.

We believe that our strict valuation discipline will ensure that the portfolio keeps up when markets are strong, whilst our focus on quality will provide downside protection when markets are weak. Meanwhile, we see growth as a style for all seasons. We believe this well-rounded approach has been the key driver of our consistent outperformance to date.

We also believe in running a portfolio with a high active share as we view ourselves first and foremost as stock pickers. Thus, we expect to maximise our alpha by concentrating capital in only our highest conviction ideas. As a result, the portfolio will usually hold between 50-60 stocks and active share will typically be between 75-85%.

Finally, while this is a multi-cap investment approach, we usually focus on the small- to mid-cap segment of the market as these companies tend to be under-researched and are therefore often significantly mispriced. This part of the market is a lucrative hunting ground for stock pickers such as ourselves. The fact that we constrain our capacity is a key competitive advantage in this regard as it allows us to access these small and mid-sized companies and enables us to actively manage the portfolio over time. Based on our current methodology and prevailing market liquidity conditions, we expect the strategy’s capacity to be around $1bn.

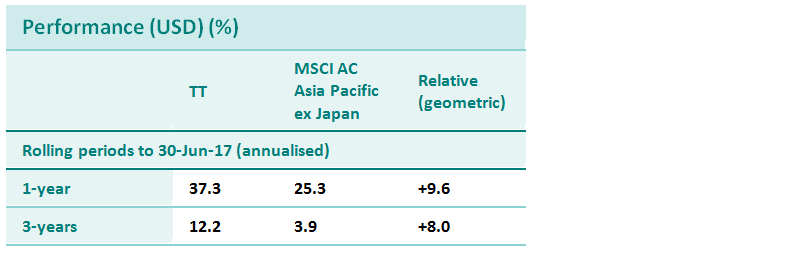

The TT Asia Pacific Asia ex-Japan strategy – 3 years into Duncan Robertson’s tenure

Three years have now passed since I took on primary responsibility for TT’s Asia Pacific ex-Japan strategy. During that time we have experienced a wide range of market conditions, as discussed at the start of the piece. Through all these ups and downs, we are pleased to report that performance numbers have consistently exceeded our 3% annual outperformance target. As can be seen below, the strategy has achieved annualised returns of 12.2% compared to benchmark returns of 3.9%, generating annualised outperformance of 8.0%.

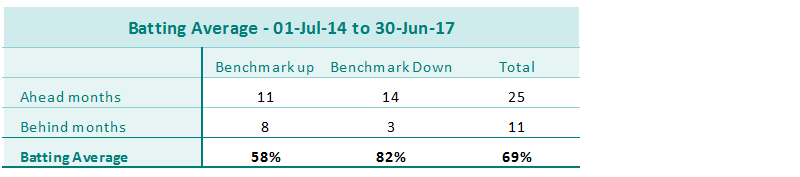

Although the team and I are pleased with the performance numbers, what is equally important to us is the consistent manner in which such performance has been achieved. Indeed, during this 3-year period, we have only underperformed in one quarter, producing a monthly batting average of 69%.

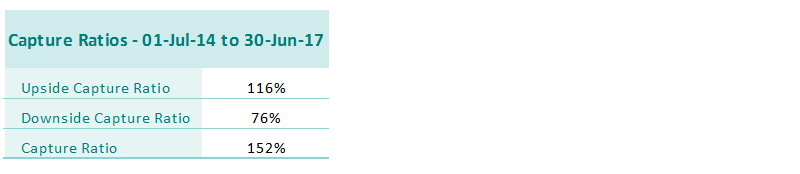

We have also been consistent in different market environments, performing well in both bull and bear markets. This can be seen in our capture ratios below.

Such consistency reflects the fact that our alpha has been well diversified by country and by sector. In fact, we have outperformed in almost every country and sector over this period.

Finally, the portfolio has performed well regardless of whether markets have been driven by value or growth stocks. Such market rotations have been extremely aggressive over the last 3 years, catching many investors out. This consistency speaks to the strength of our investment philosophy, which is to focus equally on quality and growth attributes on the one hand, and valuation on the other.

We believe the diversification of our alpha demonstrates that the close-knit team is working well together and that the investment process is sustainable, allowing us to generate attractive risk-adjusted returns for long-term investors.

TT Asia Outlook

So looking forward, what do we expect for Asian equities? In the immediate term, it would seem likely that we continue to see strong relative returns from Asian equities over their US and European counterparts. However, following an index rally of more than 20% in US dollar terms so far in 2017, more modest gains should be anticipated going forward. A key risk factor is that US equities are unequivocally expensive. Though Asia would not be immune to a correction in US markets, our conservative approach, with its sharp focus on balance sheet strength, valuation and management quality, should help to protect the portfolio in such an event. Such downside protection can be seen in the portfolio’s strong batting averages and capture ratios, as shown previously.

While we remain cognisant of risk factors such as extended US valuations, for the time being we are more focused on the upside and believe opportunities remain plentiful. Indeed, Asia is home to some of world’s most dynamic economies, with demographic tailwinds, strong domestic consumption, and low levels of indebtedness. Even the more mature Asian economies appear to be in a sweet spot, driven by improving global trade and the weaker US dollar. Opportunities ‘on the ground’ are also abundant. The team are very active in visiting companies across the region, and we have a growing list of strong candidates that could be added to the portfolio, if and when the price is right.

Ultimately, we believe that the diversity of countries, cultures, and companies within Asia provides specialist investors with an excellent opportunity for substantial alpha generation. We therefore look forward with optimism as we attempt to capture such gains for our investors.

Nothing in this document constitutes or should be treated as investment advice or an offer to buy or sell any security or other investment. TT is authorised and regulated in the United Kingdom by the Financial Conduct Authority (FCA).