As concerns mount over China’s spluttering economy and its beleaguered property sector, investors are dumping Chinese assets and the central bank has been forced to step up its defence of a sliding renminbi. With this in mind, we thought you would appreciate a brief update on our thoughts about China and its property market specifically, as well as other major Emerging Markets. We continue to believe that developing economies will remain the world’s growth engine over the next couple of years as central banks cut rates to stimulate domestic activity. Nevertheless, the outlook is mixed for markets across the asset class, highlighting the enduring importance of integrating top-down macroeconomic analysis with bottom-up stock selection.

China

Needless to say, China’s economy and equity markets have disappointed investors this year, and are clearly suffering from economic long-Covid. The main causes are a lack of confidence from both businesses and consumers about the economic outlook, coupled with the negative wealth effect from a deflating housing bubble, and the need to shift China’s growth model from investment to consumption. Trade wars, technology sanctions and geopolitical tensions are further reasons for international and domestic investors to be risk adverse when it comes to China. Unfortunately there is no quick fix for most of these issues. China simply grew too quickly by substantially leveraging up following the Global Financial Crisis, given a backdrop of abundant cheap capital, compliments of the US Federal Reserve. With globalisation and domestic consumption in full swing during this period, economic returns on projects in China were strong. However, such returns have been severely eroded as two-thirds of China’s investment is now directed into the property and infrastructure sectors, which have become increasingly wasteful economically.

What

are the root causes of China’s current economic malaise?

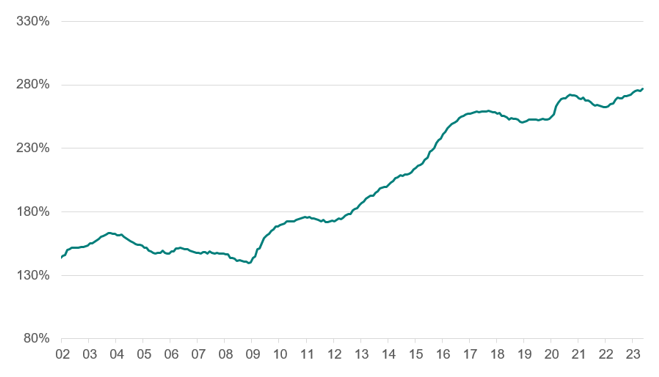

1. High

debt – China’s Debt/GDP is 300%. Continuing to leverage up isn’t really an

option, especially when growth is slowing. (Chart 1 below)

Chart 1 – Loans as % of GDP

Source: Emerging Market Advisors

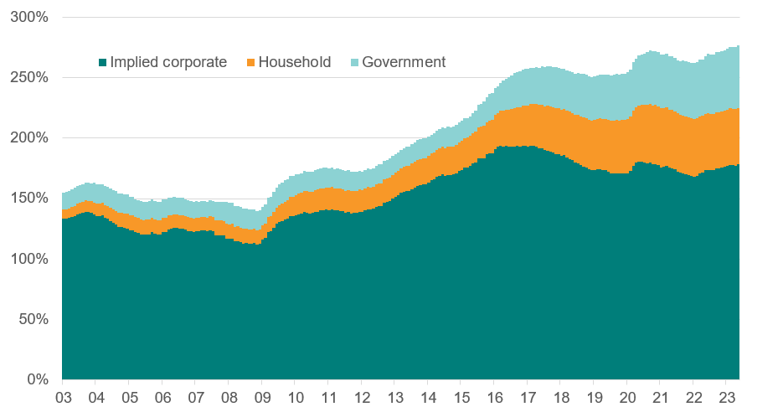

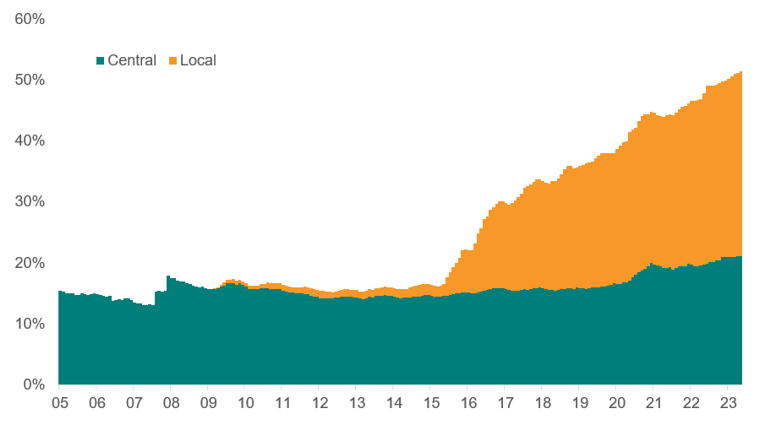

2. Another important issue is the composition of leverage. Since 2017/2018, when the government became increasingly involved in managing the economy, corporations have reduced their leverage (Chart 2), while the government sector has stepped it up. This is problematic because it is an inefficient allocation of capital. Even in leading developed markets, the efficiency of government-directed investments is sub-optimal, let alone in China where the stock of FAI and Fixed Capital/GDP are high. To make matters worse, most of the uptick in leverage in the past few years occurred at the local government level, which is concerning as these entities are almost entirely reliant on land sales for their revenues (Chart 3).

Chart 2 – Total Domestic Financial Claims (% of GDP)

Source: Emerging Market Advisors

Chart 3 – Government bond debt (% of GDP)

Source: Emerging Market Advisors

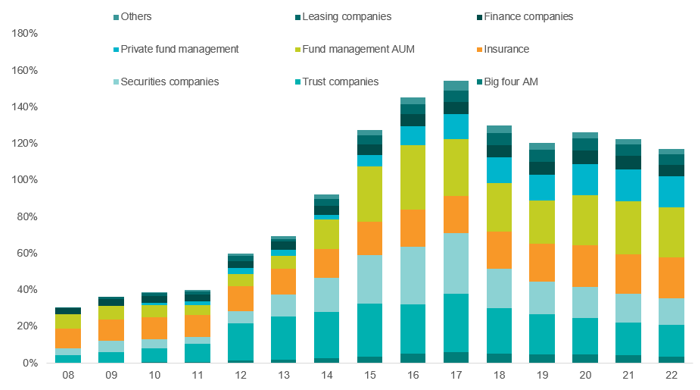

3. When a government competes for capital against the markets, it will win. This is manifest in the shrinkage of securities firms and trust companies since 2017/2018 in terms of Assets as % of GDP (Chart 4). Whilst governments inherently have a lower cost of financing, their investments also tend to generate much lower returns.

Chart 4 – Non-Bank Financial Assets (% of GDP)

Source: Emerging Market Advisors

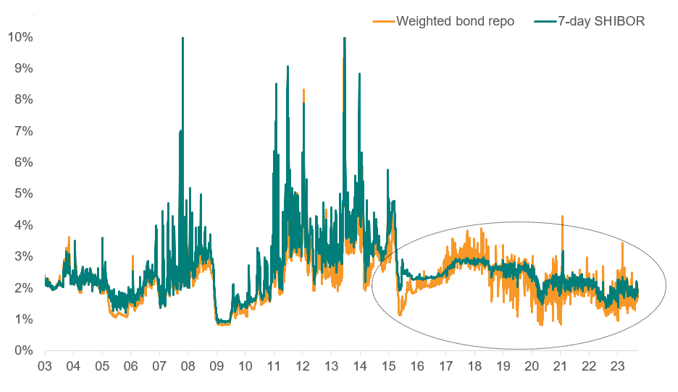

Chart 5 – Interbank rates

Source: Emerging Market Advisors

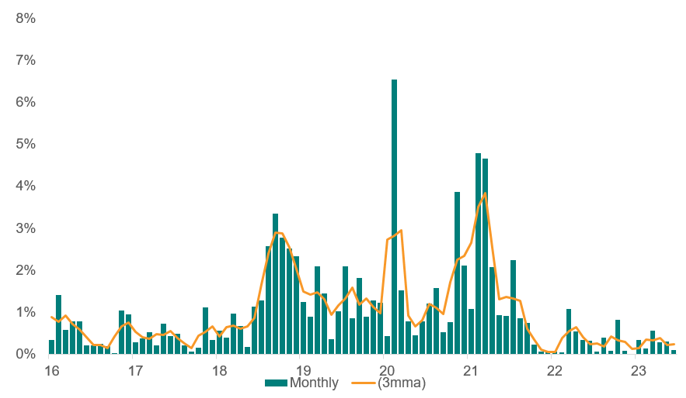

Chart 6 – Domestic bond default rate (annualised 3mma)

Source: Emerging Market Advisors

4. China’s growth model driven by infrastructure and investment is reaching its limits, and the country will have to shift towards a consumption-driven economy. This will require the rate of investment to decline, meaning that either consumption growth must rise sharply to fill the void, or GDP growth must fall substantially. Unfortunately, the former is only possible through politically contentious transfers from government to households.

So what are the possible solutions available to Beijing?

1. The government redirects its leverage towards consumption, which is what most developed markets did during Covid via helicopter money and cash handouts.

2. The government re-engages in infrastructure investment with the hope that it can kick-start a new consumption cycle.

3. Do nothing: the growth rate slows until it finds a new base and CPI turns positive at some point in 2H24, but the growth outlook for 2025 and beyond becomes more like that of a developed market.

4. Policy setters acknowledge bond defaults, and allow capital markets to find a solution to the necessary recapitalisations. This would be similar to the 2008 US housing crisis solution, where banks sold off portfolios of MBS and defunct loans to vulture funds and distressed asset managers.

What

are the potential outcomes for capital markets?

1. Should the government announce some form of major consumption stimulus, the economy could potentially reflate, allowing for deleveraging to take place in 2025 and beyond.

2. Fiscal stimulus would have a short-term positive impact on the markets and invariably generate some consumption, albeit weaker than in previous cycles. Markets would likely rally but then fade as the magnitude of the infrastructure investments is likely to disappoint.

3. Do nothing solution: markets trade sideways/range-bound for the next 12 months, until the global rate cutting cycle begins in earnest. This could then redirect capital to a market that has underperformed and is reasonably attractively valued versus its history.

4. ‘Big Bath’ solution: this requires short-term pain tolerance from policy setters as the situation will likely get worse before better. However, it would improve the fundamentals of the banking system and capital markets in the longer term.

Which path is the government likely to choose?

In our view, Beijing will likely opt for some combination of options 1 and 2, which will likely underwhelm the markets. It will also have to accept elements of option 3, particularly if it continues to prioritise national security and self-sufficiency over growth. This is part of the reason that we are structurally underweight China.

The one caveat is that we are at the bottom end of the range on both valuations and technicals in the H-share and A-share markets. Consequently, we may look to tactically reduce the underweight, but that would not represent a shift in our structural view unless the situation changes materially.

Chinese real estate

The Chinese real estate market is experiencing a hard landing due to missteps from heavy-handed government policy and the aftereffects of Covid-19. Below we examine the possible scenarios and risks for the Chinese economy.

What is happening?

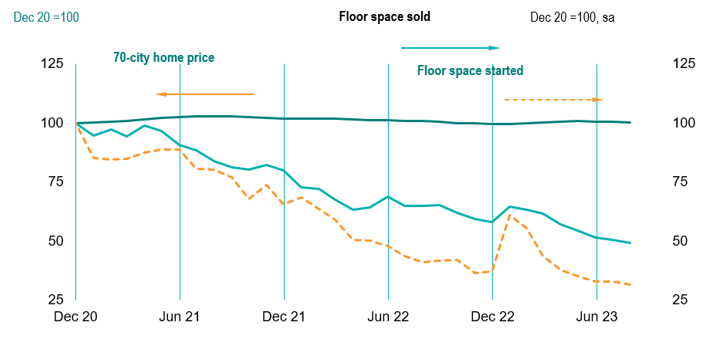

- As can be seen in Chart 7 below, over the past 3 years housing floor space sold in China has nearly halved, leading to knock-on effects for consumption and the economy.

Chart 7 – Chinese housing market (sales, starts, home prices)

Source: NBS, CEIC, J.P. Morgan

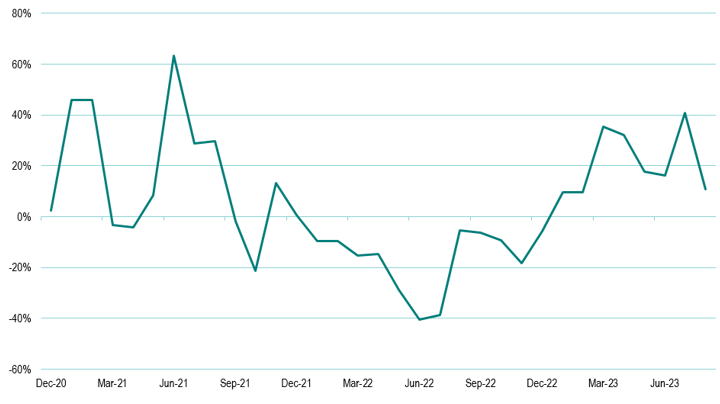

Chart 8 – Chinese residential GFA completions (YoY change)

Source: NBS, CEIC, J.P. Morgan

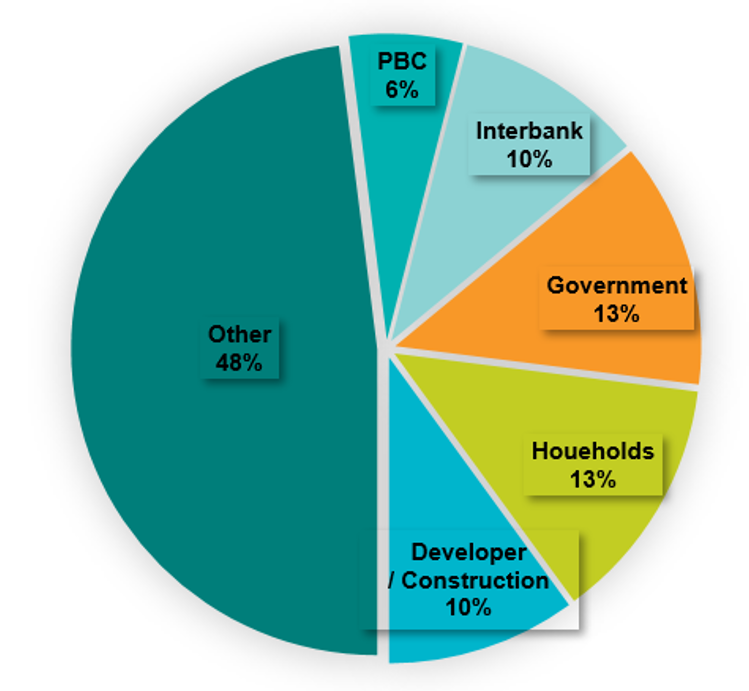

Chart 9 – Bank exposure to real estate (commercial bank claims as at end 2022)

Source: Emerging Market Advisors

- This slowdown began in 2020 due to tight funding conditions and home purchase restrictions. As the Gross Floor Area sold started to decrease, developers such as Evergrande, Sunac and Shimao ran into liquidity issues as banks held back capital from pre-sales projects, aware that developers’ balance sheets were deteriorating.

- More recently the liquidity crisis was exacerbated by rising US interest rates as many developers relied on cheaper offshore funding due to low US Fed Funds rates.

- Policy setters were late to offer liquidity support, but have since provided sufficient liquidity via a bailout fund of RMB300bn to ensure the completion of floor space that has already been sold. This has allowed developers to begin completions. For example, work is now underway at 80% of sold-but-uncompleted projects at Evergrande.

- Whilst there is now an escalating debt crisis at Country Garden and other Privately-Owned Enterprise developers, policymakers have prepared sufficient funding for their ~2000 projects to be completed. This means that bond/trust/wealth management product investors will bear the brunt of the pain and will take haircuts on their investments in both price and duration terms. This should mean that bank writedowns are less likely to see a massive spike higher, but it will have a significant impact on the velocity of money as investors and savers absorb losses. Unfortunately, we believe that the full extent of the shadow banking system’s exposure to the property sector is under-recognised by investors, as exemplified by the ongoing issues at shadow bank, Zhongrong.

- Thankfully, real estate exposure via developer loans and mortgages account for only 23% of banking system assets. Moreover, mortgage loan-to-values are low in China. These two factors could prevent a dire situation from morphing into a systemic banking crisis.

- Reverting back to the solid blue line in Chart 7 above, we can see that home prices are declining steadily with low volatility. This is no coincidence – it is by policy design. In order to maintain social order and stability in the banking system, officials are managing the decline of home prices.

- This lack of a free market ultimately leads to large amounts of unsold inventory without any bids i.e. current home prices are far higher than the market clearing price.

- In order to stem the bleed in the real estate market, policy setters need to allow for prices to fall freely. This will undoubtedly lead to acute temporary pain, but help to address the excess inventory and unlock a massive pool of trapped liquidity, which is dragging down GDP growth. This is what US policy setters allowed after the collapse of their own real estate market, when vulture funds and distressed asset managers bought MBS and blocks of unfinished projects en masse.

- Alternatively, the government could take a leaf out of its 2016 shantytown redevelopment playbook and move rural residents into empty homes via cash-for-land/shantytown home transfer programmes. By serving as the buyer of last resort, the government would potentially help to eliminate excess inventory and restore some confidence in the market.

- Absent additional government support, the current round of completions will end in 2H24, leading to a further deceleration in China’s GDP growth rate in 2025 and beyond.

How are we positioned?

We have no exposure to Chinese real estate developers. More generally, our strategy in China over recent months has been to concentrate exposure in A-share stocks that we regard as structural compounders. These stocks have not escaped the recent China sell-off, despite continuing to grow earnings at 20-30%, and have therefore de-rated heavily. However, we believe they will rally strongly once sentiment turns, protecting the portfolio in such an event.

The issues discussed above are key factors behind our structural underweight exposure to China. We will now provide a short update on our other major active positions.

Asia ex-China

Amid China’s economic woes, it is easy to forget that Asia offers some of the most exciting structural growth opportunities in the world. These range from domestic demand plays in underpenetrated markets such as India and Indonesia to companies in Taiwan and Korea that are helping to drive technologies of the future like AI and EVs. The portfolio has exposure to these themes and many others in Asia.

Mexico

We believe Mexico will be the biggest winner of the ongoing divorce between the US and China, given its location, trade-agreements, economic stability and low-cost labour pool. Indeed, Mexican wages in the manufacturing sector are now roughly one-third of those in China. Based on FDI investments that have already been announced, we expect Mexican exports to the US to increase by $150bn, which equates to 10% of GDP. The majority of this investment is likely to flow into the north of the country. We therefore own banks and airport operators that have significant exposure to this area.

Brazil

Brazilian stocks have struggled in the risk-off mood of recent weeks, partly because Brazil is generally a high-beta market, but also because of concerns that there will be increases in corporate taxation as the government aims to prioritise fiscal rectitude. However, companies have strong lobbying power in Brazil and any proposals will likely be watered down as they pass through Congress. More importantly, Brazilian real rates remain around 10% when the historic average is under 4%. We still believe that the country could see rate cuts of up to 400bps by the end of next year. We are therefore sticking with the overweight, and indeed are inclined to add further to it. Most of our stocks are beneficiaries of falling rates and are trading at 1-2 standard deviations ‘cheap’ versus history. We expect them to rally strongly once rate cuts gain momentum.

Argentina

There was a political surprise in Argentina as radical libertarian Milei took a shock lead in the primary election, suggesting that almost two-thirds of the population are now inclined to oust the current Peronist regime. Milei is seeking to open up and dollarise the economy, bring the budget into surplus, sign numerous free trade agreements, pivot away from China towards the US, privatise companies en masse and remove export restrictions. Overall his agenda is market friendly, but could be disruptive in the sense that he wants to instigate a lot of change in a very short period of time, so there is significant execution risk. Milei’s manifesto would likely be positive for our stocks, which are exporters of oil and lithium.

We hope that you found this update useful. Please don’t hesitate to get in touch using the details below if you have any questions.

Important information: This document is issued by TT International Asset Management Ltd (“TT”), authorised and regulated in the United Kingdom by the Financial Conduct Authority. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. The circulation of this document is restricted to professional investors as defined in the legislation of the jurisdiction where this information is received. No representation is made as to the accuracy or completeness of any information contained herein, and the recipient accepts all risk in relying on this information for any purpose whatsoever. Without prejudice to the foregoing, any views expressed herein are the opinions of TT as of the date on which this document has been prepared and are subject to change at any time without notice. TT does not undertake to update this information. Any forward-looking statements herein are inherently subject to material business, economic and competitive risks and uncertainties, many of which are beyond TT’s control and are subject to change. The information herein does not constitute an offer of shares or units in any fund, and it is not an offer to, or solicitation of, any potential clients or investors for the provision by TT of investment management, advisory or any other comparable or related services. No statement in this document is or should be construed as investment, legal, or tax advice, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations. This document expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient. Any person considering any investment should consult the offering documentation if and when is made available. Investments carries with it a high degree of risk. Past performance is not necessarily indicative of future results and investors may not retrieve their original investment.