TT’s Global SMID-Cap strategy recently celebrated its first anniversary, beating its benchmark by +8.1% gross (+6.9% net) in the year to 28th November 2023. In the three months since, it has added a further +5.4% gross (+5.1% net) of outperformance. We are delighted with these results and are pleased to see that the time we spent constructing our philosophy and process is paying off for our clients. This paper elucidates our approach to delivering Thematic Alpha, wherein we concentrate our team's investment expertise on global themes. It also delves into our Fundamental Alpha, achieved through a disciplined stock-picking framework encompassing Quality, Growth, and Valuation factors. Finally, it discusses Sustainable Alpha, leveraging TT's advanced ESG capabilities to align the portfolio with the UN Sustainable Development Goals. By combining multiple sources of alpha into our investment process, we aim to continue delivering outperformance for our clients.

Thematic Alpha

Thematic investing improves hit rate

Thematic investing aims to maximise a portfolio’s exposure to the most powerful long-term growth opportunities across equity markets. Such growth is ultimately driven by the seismic structural shifts taking place globally, most notably technological progress, changing demographic and sociological patterns, societies’ environmental priorities, and top-down macroeconomic dynamics. Clearly it is easier for a company to grow with the wind at its back, so constructing a portfolio that is aligned with these structural tailwinds should increase our chances of investing in companies that can grow faster and more persistently than their valuation implies. The following graphic shows the four overarching thematics and sub-themes that the strategy focuses on.

We firmly believe that an actively-managed thematic portfolio will deliver significant outperformance over time. Until now it has been difficult to confirm this empirically because many so-called ‘thematic’ portfolios aren’t truly thematic, and many core portfolios have themes at the heart of their process. However, a recent study used a novel approach based on machine learning to identify mutual funds with high or low thematic concentration. It found that between 2006 and 2018, portfolios with high thematic exposure outperformed those with low thematic exposure by 3-5% per annum (top-minus-bottom-decile). Superior thematic alpha was robust, even after controlling for factor model returns, industry concentration and portfolio active share (Bai, Tang, Wan & Yuksel, 2023).

Perhaps the most interesting finding was that stocks with high thematic exposure did not outperform those with low thematic exposure. Rather it was thematic portfolios that outperformed, highlighting the value of an actively-managed product. Drilling down further, highly thematic portfolios were found to achieve better returns from stocks once they bought them, those stocks were then more likely to deliver positive earnings surprises, and stocks that were subsequently sold were more likely to underperform (again based on top-minus-bottom-decile of thematic concentration). Bai et al concluded that fund managers utilising a thematic approach have gained an informational advantage over generalist portfolios. That is to say, alpha has been driven by thematic fund managers using their expertise to pick the right overarching themes and stocks within those themes, and by making quantifiably superior trading decisions. Our experience mirrors that finding. We focus on a relatively narrow group of themes, gaining a deep knowledge of their underlying drivers and the long-term investment opportunities within them. By applying this expertise, looking up and down the value chain, and ignoring arbitrary industry categorisations, we aim to identify the best thematic investments available across the globe.

Active versus passive

If the key benefit of thematic investing is that it aligns a portfolio with secular tailwinds, this raises an obvious question: why not simply use a thematic Exchange-Traded Fund (ETF)? They are certainly marketed as cheap, flexible tools to capture long-term growth. However, the uncomfortable truth is that thematic ETFs have underperformed broad market indices by ~30% over their first 5 years (Ben-David et al, 2022). That’s because these products are often launched near the peak of euphoria around a theme, meaning they are typically filled with expensive stocks that eventually disappoint on future earnings growth. For example, in 2010 investors were extremely optimistic about the growth of solar power, leading to many solar ETFs being launched. Over the next five years, installed solar capacity did increase rapidly as expected – by around 5 times – yet solar ETFs underperformed the market by over 50% as the technology became commoditised and returns on capital were crushed. This serves as a stark reminder that not all growth is of equal value to investors. Crucially, a thematic growth lens is only one part of our investment philosophy. We also have a disciplined approach to valuation and quality that should see us avoid over-hyped companies that often produce disappointing investment returns. ETFs do not have the same flexibility. By their very nature, they will invest in a broad basket of thematic stocks, including the most expensive ones that are likely to ultimately disappoint.

Fundamental Alpha

Powerful combination of Growth, Value and Quality

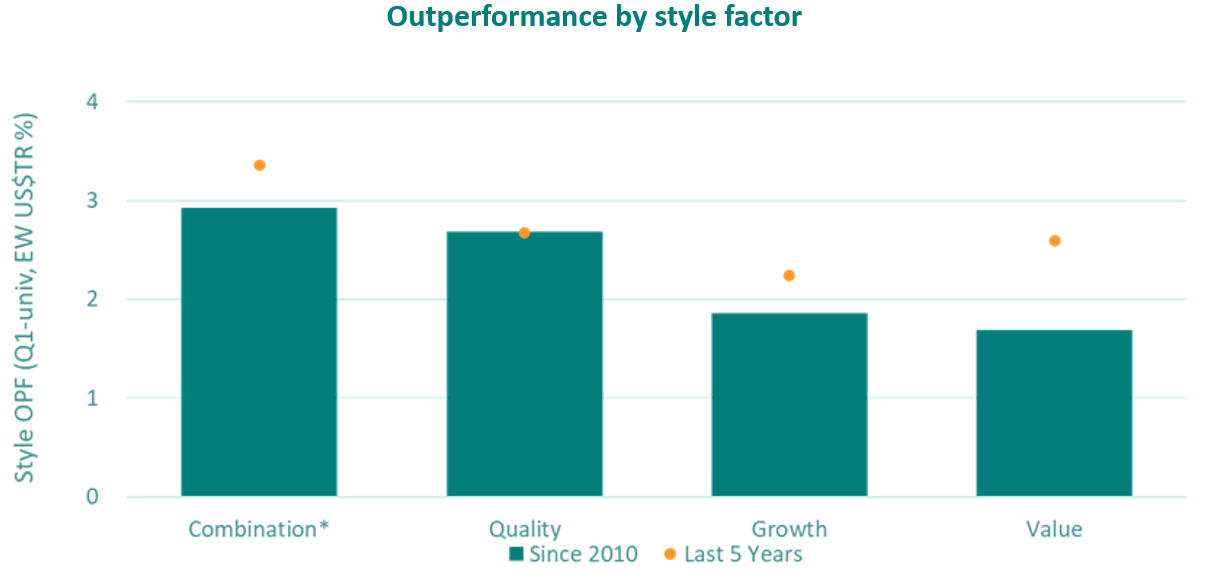

As can be seen from the chart below, a portfolio that combines Growth, Quality and Value characteristics is likely to outperform substantially over time.

*Combination of Quality, Growth and Value. OPF = outperformance.

Source: Jefferies, TT International. Based on actual next 12-month EPS growth (data without lagging).

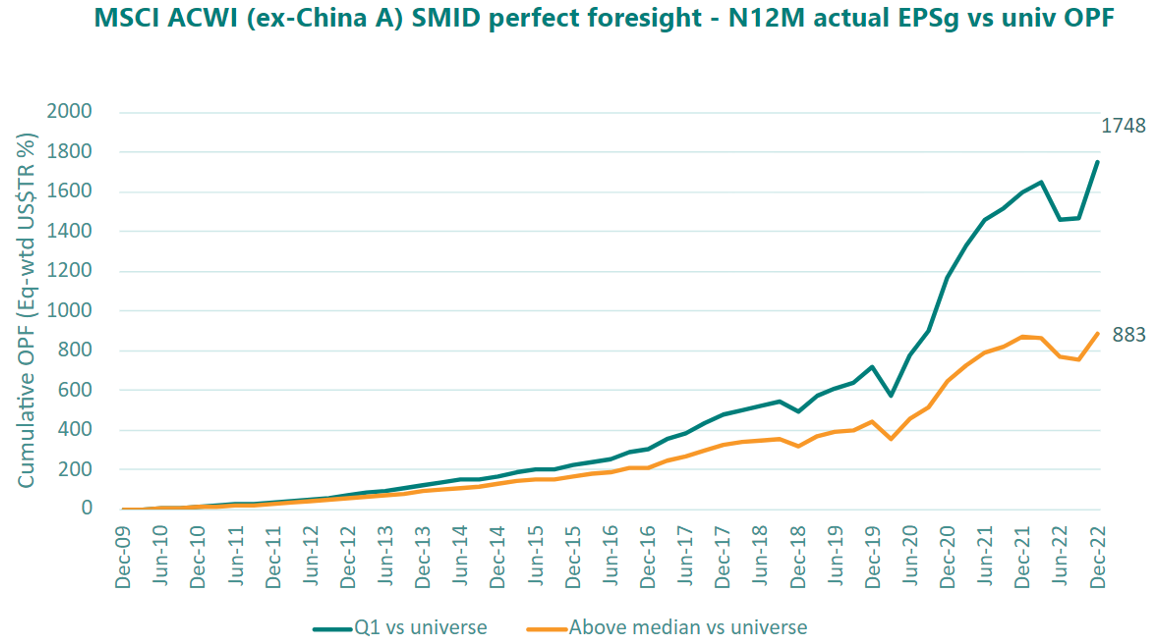

Unlike some thematic portfolios, our philosophy is not myopically focused on Growth as we know that integrating Quality and Value delivers superior alpha over time. However, we do understand how important future earnings growth is for investment returns. That’s why the team spends so much time analysing and forecasting companies’ growth potential. If we had perfect foresight and were able to successfully identify stocks that persistently generated elevated earnings growth, the impact on portfolio returns would be transformational, as can be seen from the chart below.

Source: Jefferies, TT International. Based on actual next 12-month EPS growth (data without lagging).

Academic studies confirm this, finding that the top performing 200 stocks in any decade since 1960 have produced earnings growth at twice the rate of the average firm (Bessembinder, 2021). Of course, predicting the future is difficult in an uncertain world. But by ensuring that the portfolio benefits from strong top-down and thematic drivers, combined with detailed stock-specific analysis, we aim to increase the likelihood of holding companies that will consistently deliver elevated earnings growth.

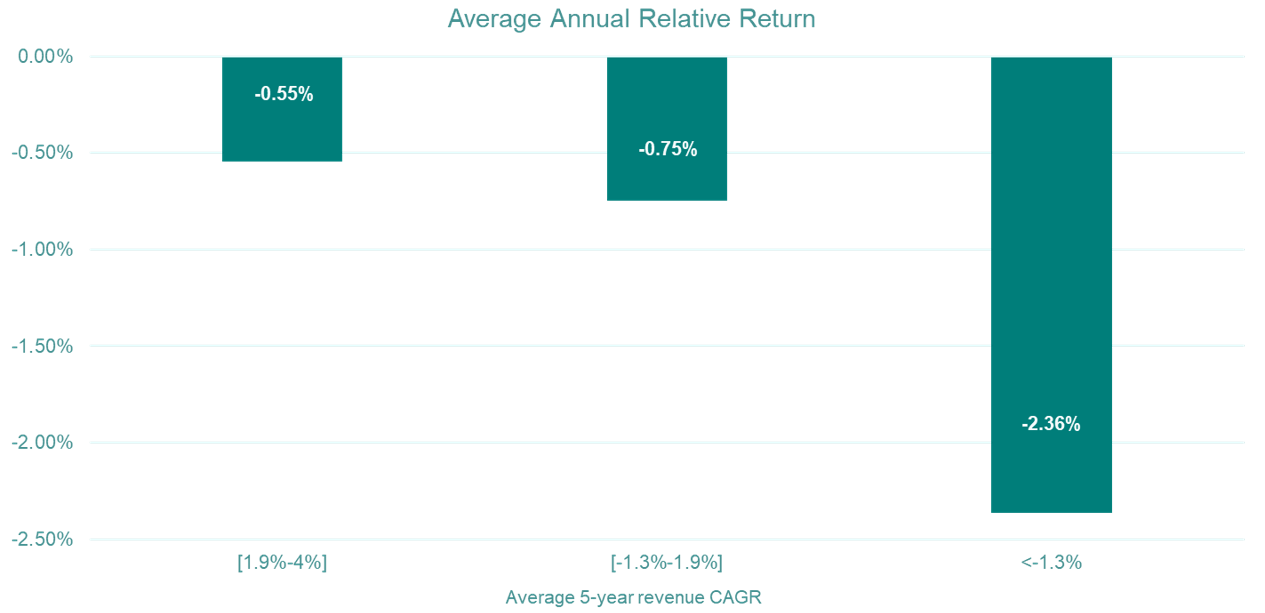

Our thematic framework also helps us avoid low-growth value traps – stocks that appear cheap but ultimately destroy value. Indeed, evidence shows that companies which have grown revenues at a 5-year CAGR of less than 4% go on to underperform the market over the following year.

By requiring our investee companies to grow revenues by at least the rate of nominal GDP, we should avoid these stocks that drag on investment returns.

Clearly there is also a risk that investment returns are impacted by overpaying for elevated growth, which is why we have a sharp focus on valuation too. With this in mind we follow a price target driven approach, meaning that we:

- Have 18-month price targets for every stock in the portfolio that we update regularly with any new information.

- Endeavour to construct these price targets as consistently as possible.

- Monitor the upside to price targets at our weekly meetings.

- Seek to ensure that position sizes are aligned with valuation upside and conviction levels.

If we cannot realistically upgrade a price target, then we are willing to sell a stock for no other reason than it has exceeded that target, or because we have much greater upside elsewhere. We do this to maintain valuation discipline and ensure a strong combination of Quality, Growth and Value in the portfolio. We believe this differentiates us from many Growth/Quality funds, and especially the typical thematic fund, which may be more valuation agnostic.

Crucially, studies show that investing in companies that combine both Value and Quality characteristics delivers significantly more alpha with fewer drawdowns and periods of underperformance than simply investing in Value companies alone (Novy-Marx, 2012). Even Benjamin Graham, the ‘father of Value investing’, incorporated Quality into his stock selection criteria. In fact, four of his seven rules of investing refer to Quality, with only two to Value and one to Growth. A similar approach combining Quality with Value has delivered significant alpha for clients of Jeremy Grantham, Joel Greenblatt and many others. Standing on the shoulders of these investment giants, we are confident that our approach of integrating Quality with Value and Growth will also deliver strong risk-adjusted returns for our clients.

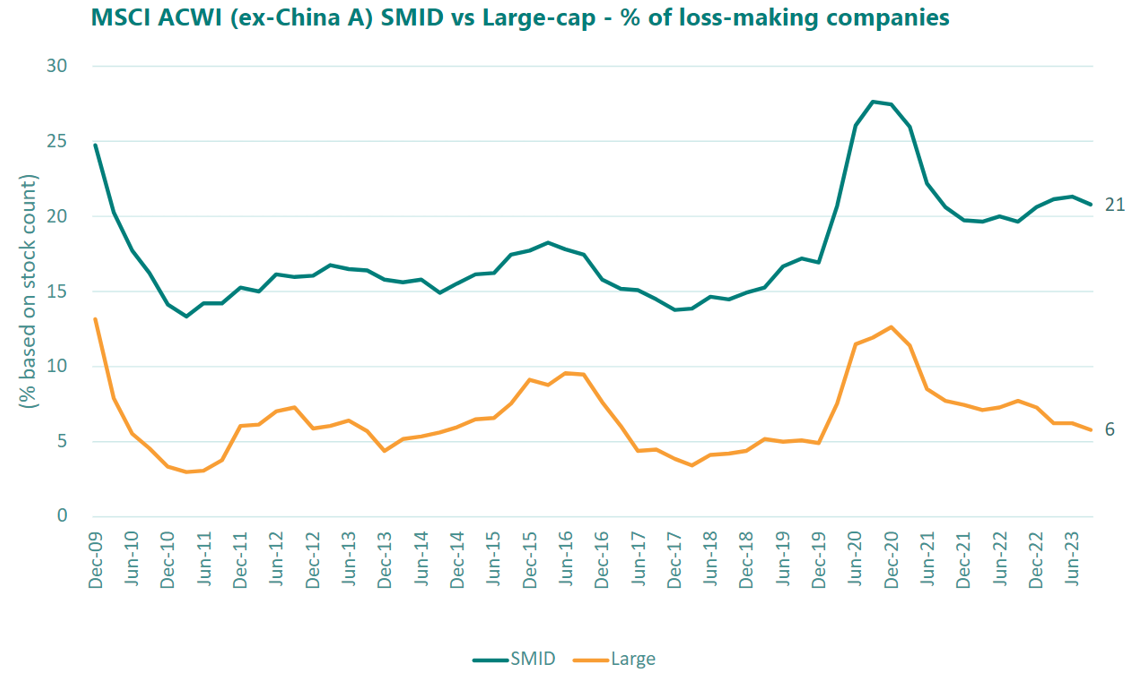

In fact, evidence suggests that a focus on Quality is even more important in the smid-cap space, where a far higher proportion of companies are lossmaking.

Source: Jefferies, TT International. Based on 12-month trailing EPS (data without lagging).

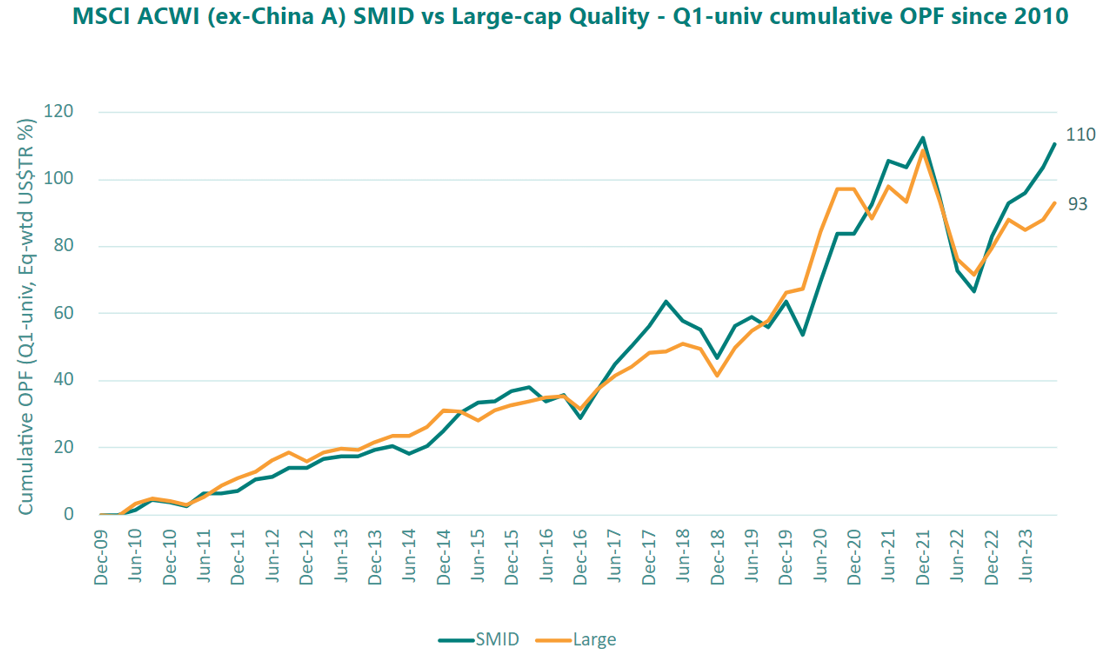

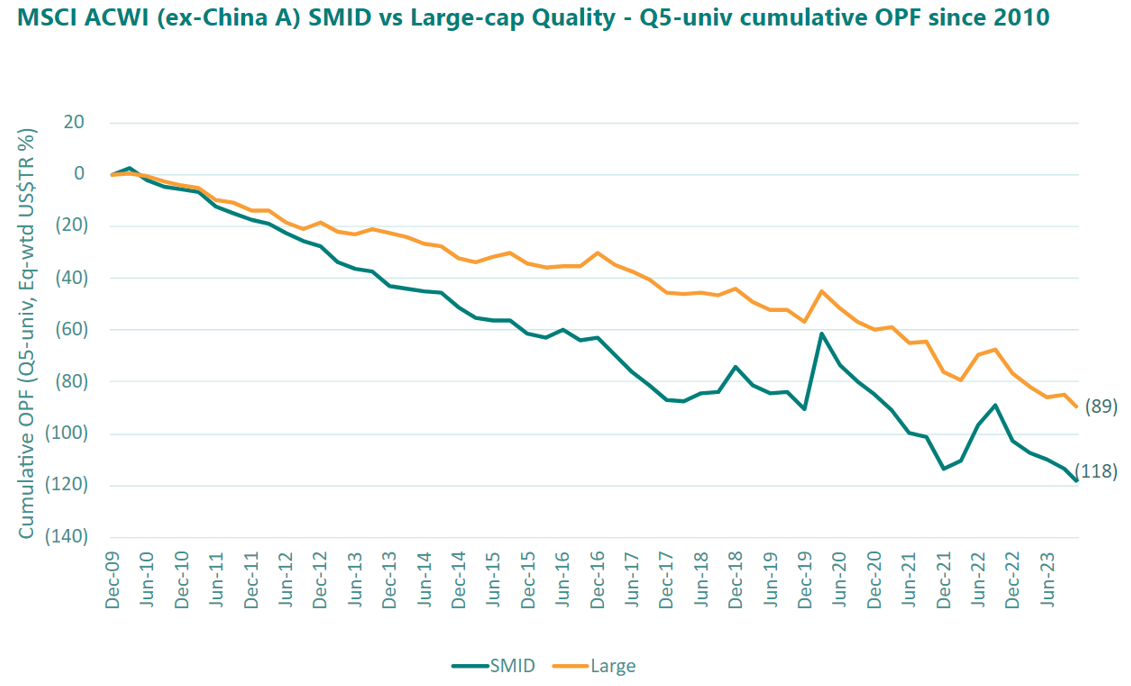

Whilst the highest-quality smid- and large-cap companies tend to outperform significantly over time, the effect is even greater in the former.

Source: Jefferies, TT International

Crucially, the worst-quality companies detract far more from performance in the smid-cap space, which is unsurprising given the amount of lossmaking companies there.

Source: Jefferies, TT International

Because Quality is so important in a smid-cap context, our process focuses heavily on this factor. It has several features which have been specifically designed to ensure we avoid the low-quality stocks that can be so damaging to investment returns. When assessing the quality of a company, we consider four overarching aspects:

- Management quality – track record, governance and incentives

- Value creation – industry structure, sustainable competitive advantages, Return on Capital Employed

- Balance sheet strength – current balance sheet position, future free cash flow generation

- Sustainability – alignment of products and conduct with the UN Sustainable Development Goals

To mitigate the risk of investing

in low-quality stocks, our process contains elements such as a Question

Session, Counter-Thesis and Fundamental Stop-Loss. Shortly after an analyst

commences their research on a new stock idea, they meet with the investment

team for a Question Session. This is similar to

a brain-storming exercise; its purpose is to canvass the entire team for their

initial ideas on the key questions that the analyst should be asking. By doing

so, we leverage the team’s substantial investment expertise to ensure that the

analyst benefits from a broad range of perspectives. This guards against the

potential for confirmation bias and enables us to kill bad ideas quickly,

rather than wasting precious research resources on them. It also helps to

identify particular areas that the analyst should focus on

if it is decided that they should continue their research.

Following a favourable outcome from the Question Session, an analyst will spend time building conviction in an Investment Thesis. We also develop a Counter-Thesis to understand opposing views and why we differ, as well as what could potentially go wrong. To formulate the Counter-Thesis we speak to bearish analysts and industry experts, and also interrogate our financial models for weaknesses. Even when speaking with bullish analysts, we will ask them about the pushback they have received when pitching the stock, and the key factors that have prevented others from investing. As part of the Counter-Thesis, we look to identify Fundamental Stop-Loss Events. These are potential major issues that would almost certainly lead us to sell the stock immediately if they came to pass, subject to price levels. The Fundamental Stop-Loss and overall Counter-Thesis are important risk management tools. By focusing on the other side of the argument, no matter how exciting a stock appears, we should be better able to avoid investing in superficially attractive, but ultimately low-quality companies, thereby improving our hit rate further.

Sustainable Alpha

Our interrogation of a company’s Quality, Growth and Value characteristics is enhanced by fully integrating sustainability and ESG factors into the investment process. We believe this approach will improve the strategy’s risk-adjusted returns in the long run. Indeed, companies operate under a social and regulatory contract; those that breach this are likely to see negative outcomes, from consumer boycotts to fines or even closure in extreme cases. Thus, the sustainability of a company’s returns is impacted by the sustainability of its operational conduct.

With this in mind, we use the UN’s Sustainable Development Goals (SDGs) as a global framework to better identify the quality of a company’s fundamentals and reduce downside risks to our investments. We consider alignment with the UN SDGs in two separate ways:

- What the company does.

At least 50% of the portfolio will be invested in companies that directly contribute to the UN SDGs through their primary business activity. An example would be our investments in Indian Financials that are delivering economic inclusion to society. This assessment is conducted by the fundamental analyst, working closely with TT’s ESG team.

- How the company does it.

At least 80% of the portfolio will be invested in companies that are aligned with the UN SDGs through their operational conduct. This focuses on how a company behaves, considering its impact on the environment and its workers. For example, we undertook particularly rigorous analysis of the supply chains of our Sports & Wellness apparel investments, given concerns over cotton-sourcing practices in the industry. This assessment is conducted by TT’s ESG team, working closely with the portfolio team.

Additionally, companies that derive more than 10% of their revenues from the following categories are excluded from investment: fossil fuels and related sectors; tobacco; cannabis; alcoholic beverages; gambling; weapons; and adult entertainment.

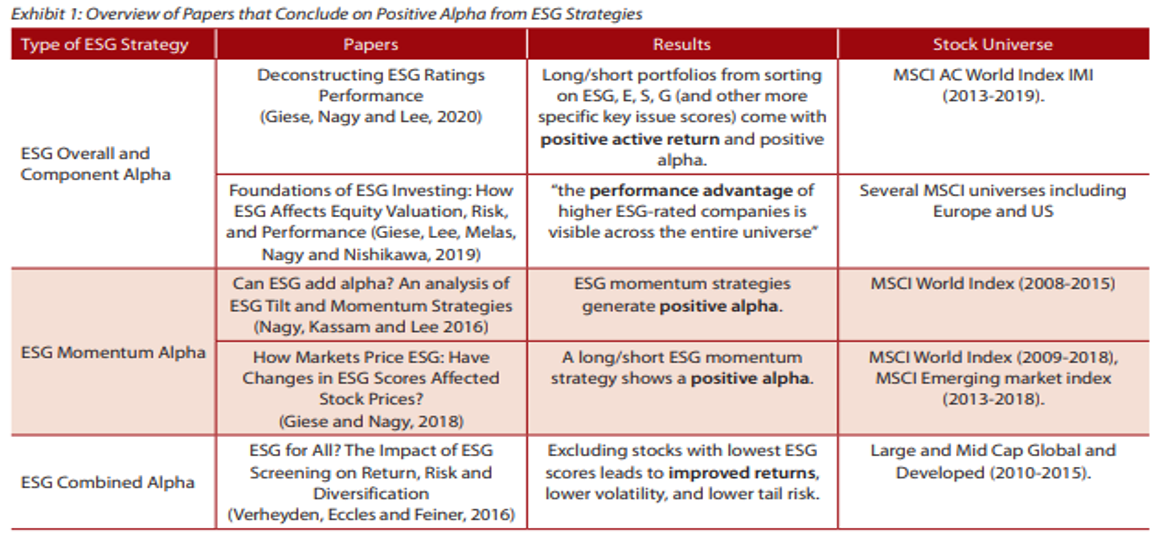

As can be seen from the summary below, there is a strong body of empirical evidence suggesting that integrating ESG factors have driven positive alpha over time.

Source: Scientific Beta

ESG alpha has been quantified in many of these studies at between 1-3% per annum. When compounded over years and decades, such gains would clearly be transformational for our clients’ returns.

Of course, we understand that past performance is no guarantee of future investment returns. Strong historic performance has resulted in an ESG valuation premium that reached as high as 50% on some measures in 2022 (SustainEx Database). Clearly this could undermine future returns, and perhaps unsurprisingly we have seen a partial unwind of this premium over the past 18 months or so. That’s why our approach does not simply rely on ESG factors in isolation; we integrate sustainability analysis into our fundamental process in order to make better judgements on a company’s quality characteristics, growth prospects and intrinsic valuation.

Quality is closely related to sustainability, and much of the alpha delivered in the academic literature cited above is correlated with Quality as a factor. Importantly, an ESG perspective gives us incremental insights into the quality of a company’s management and operations. With respect to Growth, sustainable themes are more likely to gain support from governments and consumers, and have less regulatory risk, helping analysts to build more conviction in their durability.

Such Growth and Quality considerations are integrated into our intrinsic valuation assessment and target price. While companies exhibiting sustainable growth characteristics often have premium valuations, we believe this is justified because in an uncertain world, investors can have greater conviction in a sustainable growth path, where there are likely to be stronger tailwinds and more upside risks. Meanwhile, we have minimum levels of fundamental and ESG quality for the portfolio, such as returns on capital or financial leverage, as well as appropriate governance or environmental compliance. Being disciplined on both aspects of quality helps the portfolio avoid value traps – companies that appear cheap but are not good value.

As can be seen, the TT Global SMID-Cap Strategy incorporates many aspects that empirical evidence suggests are particularly effective in generating long-term outperformance. By focusing on under-researched global smid-cap stocks, harnessing the power of thematic investing, combining Growth, Quality and Value characteristics, and integrating sustainability and ESG factors, we hope to continue delivering substantial alpha for our investors.

References

Bai, J.J., Tang, Y., Wan, C. and Yuksel, H.Z., 2023. Thematic investing in mutual funds. Zafer, Thematic Investing in Mutual Funds (September 19, 2023). Northeastern U. D’Amore-McKim School of Business Research Paper, (4164823).

Ben-David, I., Franzoni, F., Kim, B., & Moussawi, R. (2023). Competition for Attention in the ETF Space. The Review of Financial Studies, 36(3), 987-1042.

Bessembinder, H. (2021). Wealth creation in the US public stock markets 1926–2019. The Journal of Investing, 30(3), 47-61.

Bessembinder, H., Chen, T. F., Choi, G., & Wei, K. J. (2023). Long-term shareholder returns: Evidence from 64,000 global stocks. Financial Analysts Journal, 1-31.

Important information: This information is issued by TT International Asset Management Ltd (“TT”), authorised and regulated in the United Kingdom by the Financial Conduct Authority. This information is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. The circulation of this information is restricted to professional investors as defined in the legislation of the jurisdiction where this information is received. No representation is made as to the accuracy or completeness of any information contained herein, and the recipient accepts all risk in relying on this information for any purpose whatsoever. Without prejudice to the foregoing, any views expressed herein are the opinions of TT as of the date on which this information has been prepared and are subject to change at any time without notice. TT does not undertake to update this information. Any forward-looking statements herein are inherently subject to material business, economic and competitive risks and uncertainties, many of which are beyond TT’s control and are subject to change. The information herein does not constitute an offer of shares or units in any fund, and it is not an offer to, or solicitation of, any potential clients or investors for the provision by TT of investment management, advisory or any other comparable or related services. No statement in this information is or should be construed as investment, legal, or tax advice, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations. This information expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient. Any person considering any investment should consult the offering documentation if and when is made available. Investments carries with it a high degree of risk. Past performance is not necessarily indicative of future results and investors may not retrieve their original investment.